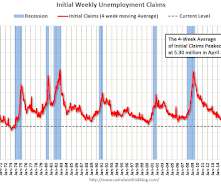

Weekly Initial Unemployment Claims at 256,000

Calculated Risk

JULY 28, 2022

The DOL reported : In the week ending July 23, the advance figure for s easonally adjusted initial claims was 256,000 , a decrease of 5,000 from the previous week's revised level. The previous week's level was revised up by 10,000 from 251,000 to 261,000. The 4-week moving average was 249,250, an increase of 6,250 from the previous week's revised average.

Let's personalize your content