A Look at the Size of the Global Commercial Real Estate Market

Wealth Management

AUGUST 13, 2023

New data from MSCI Real Assets looks at what changed in the world of professionally-managed real estate around the globe in 2022.

Wealth Management

AUGUST 13, 2023

New data from MSCI Real Assets looks at what changed in the world of professionally-managed real estate around the globe in 2022.

Calculated Risk

AUGUST 13, 2023

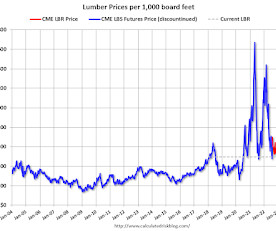

Here is another monthly update on lumber prices. SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16th. I've now switched to a new physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons since the new contract was priced about 24% higher than the old random length contract for the period both contracts were available.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

AUGUST 13, 2023

Top clicks this week The equity risk premium in the U.S. keeps falling. (economist.com) Five common personal finance lessons that are wrong. (genyplanning.com) Why are market cap weighted indices hard to beat for managers? (behaviouralinvestment.com) When do dividend-focused strategies outperform? (morningstar.com) Every investment strategy has multiple 'points of failure.

Calculated Risk

AUGUST 13, 2023

Weekend: • Schedule for Week of August 13, 2023 Monday: • No major economic releases scheduled. From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 10 and DOW futures are up 52 (fair value). Oil prices were up over the last week with WTI futures at $83.19 per barrel and Brent at $86.81 per barrel. A year ago, WTI was at $95, and Brent was at $104 - so WTI oil prices are down about 12% year-over-year.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Million Dollar Round Table (MDRT)

AUGUST 13, 2023

By Bryce Sanders Whether prospects say it or not, there are virtues they’re looking for in financial advisors to be able to trust them and then build a long-lasting relationship. Here are seven virtues most prospects are seeking in ideal advisors. This isn’t like school, though, where four out of six represents 67%, or a passing grade. The ideal advisor needs all seven virtues.

A Wealth of Common Sense

AUGUST 13, 2023

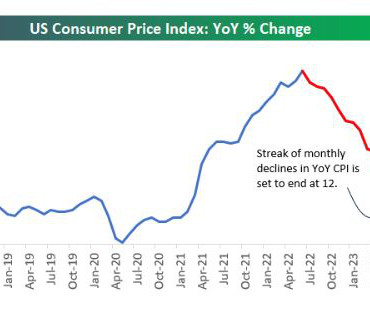

After 12 months in a row of falling annualized inflation numbers, the latest reading ticked slightly higher this month. Here are those numbers from the peak in June 2022: 9.06% 8.52% 8.26% 8.20% 7.75% 7.11% 6.45% 6.41% 6.04% 4.99% 4.93% 4.05% 2.97% 3.18% For a while there stagflation was all the rage. That risk subsided relatively quickly as the economy remained strong and the stag part of that equation fell by the ways.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Irrelevant Investor

AUGUST 13, 2023

Articles The long-term mission is more important than any short-term personal gain. (By Ian Cassell) What’s the most important thing when it comes to building wealth? (By Nick Maggiulli) “You get a narrative, you get a narrative, you get a narrative!” (By Cullen Roche) As early as 2010, people were already sounding the alarm bells about valuations being too high: (By Ben Carlson) Owning stuff builds wealth (By Tony.

Advisor Perspectives

AUGUST 13, 2023

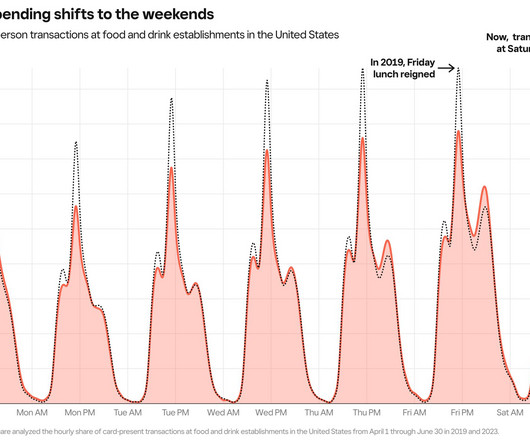

It has been nearly two years since corporate America reopened, and employers are still struggling to get people back into the office. Just ask Jamie Dimon, CEO of JP Morgan Chase, who has been pushing for in-office work, yet 30% of his workers remain hybrid and he continues to face pushback.

The Irrelevant Investor

AUGUST 13, 2023

Today’s Talk Your Book is brought to you by F/m Investments: We are joined by Francisco Bido, Senior Portfolio Manager for the Integrated Alpha group of F/m Investments to discuss large Cap Strategies. On today’s show, we discuss: F/m’s quant-active large-cap fund Screening out investable companies Understanding the growth vs value dynamic The relationship between valuation and earnings growth What turnover lo.

Advisor Perspectives

AUGUST 13, 2023

Franklin Templeton’s Head of Digital Asset & Investor Advisory Services Sandy Kaul has a wealth of experience in the financial industry and a vision for the future in the digital asset space. She finds the trend toward democratizing new investment frontiers exciting. Learn more about Sandy in this Q&A.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Abnormal Returns

AUGUST 13, 2023

Markets Should investors actually care about stock market valuations? (awealthofcommonsense.com) How have Berkshire Hathaway ($BRK.B) B shares performed since issuance? (rationalwalk.com) Finance The CDS market is picking up steam. (ft.com) Saudi Arabia's PIF is taking some big swings. (wsj.com) ESG 'Greenhushing' is the new ESG. (mutualfundobserver.com) Norway's sovereign wealth fund wants to see ESG reforms.

Advisor Perspectives

AUGUST 13, 2023

VettaFi head of research Todd Rosenbluth appeared on Yahoo! Finance to discuss ETFs with unexpected demand — including AI-focused ETFs.

The Big Picture

AUGUST 13, 2023

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Deception, exploited workers, and cash handouts: How Worldcoin recruited its first half a million test users : The startup promises a fairly-distributed, cryptocurrency-based universal basic income. So far all it’s done is build a biometric database from the bodies of the poor. ( MIT Technology Review ) • Banks fined $549 million for hiding messages in iMessage and Signal : Wells Fargo and other Wal

Advisor Perspectives

AUGUST 13, 2023

A team of scientists claimed to have created a breakthrough material that could superconduct electricity at room temperatures and ambient pressure. But then people started trying to replicate the experiment.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

AUGUST 13, 2023

Today we’ll continue reviewing Neil Howe’s magisterial new book, The Fourth Turning Is Here , focusing on the Millennial Generation’s important role in the coming crisis. Then we’ll think about what the crisis may look like. Finally—because I always try to look on the bright side—we’ll consider what Neil expects in the “First Turning” that will follow.

Advisor Perspectives

AUGUST 13, 2023

For experienced and novice investors, there are myriad complexities associated with environmental, social, and governance (ESG) ratings and scoring.

Advisor Perspectives

AUGUST 13, 2023

All of a sudden, the short-volatility trade is back on Wall Street as billions of dollars pour into options-selling ETFs like never before.

Advisor Perspectives

AUGUST 13, 2023

For the better part of the last century, the largest companies in the world were those that produced physical property – traditional transportation machines, the energy that powered them, or the capital that financed them.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

AUGUST 13, 2023

David Dali, Head of Portfolio Strategy, provides his 12-month outlook for global equity markets.

Advisor Perspectives

AUGUST 13, 2023

With the second half of 2023 underway, how are the macro and market landscapes unfolding?

Let's personalize your content