Schedule for Week of July 21, 2024

Calculated Risk

JULY 20, 2024

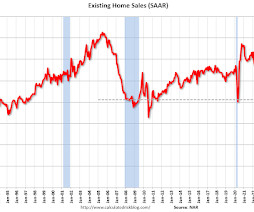

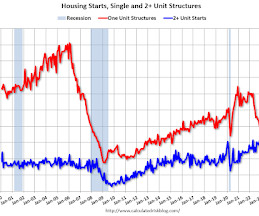

The key report this week is the advance estimate of Q2 GDP. Other key reports include June Existing Home Sales, New Home Sales, and Personal Income and Outlays. For manufacturing, the July Richmond and Kansas City Fed manufacturing surveys will be released. -- Monday, July 22nd -- 8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data. -- Tuesday, July 23rd -- 10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR).

Let's personalize your content