Savvy Adds Four Advisors With Combined $170M

Wealth Management

MAY 23, 2024

The digital-focused advisory recruits advisors from UBS, Farther and others, bringing its total assets to over $400 million.

Wealth Management

MAY 23, 2024

The digital-focused advisory recruits advisors from UBS, Farther and others, bringing its total assets to over $400 million.

Abnormal Returns

MAY 23, 2024

Strategy How modern investment scams use stolen identities to work. (sherwood.news) Bad actors are abusing your most valuable asset, attention. (theirrelevantinvestor.com) Companies DuPont ($DD) is splitting into three companies. (edition.cnn.com) Live Nation ($LYV) is being sued by the DoJ for anti-trust violations. (hollywoodreporter.com) More companies are mentioning AI in their earnings calls.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 23, 2024

A convergence of factors creates a tsunami of opportunities for advisors to demonstrate their value.

Calculated Risk

MAY 23, 2024

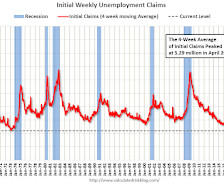

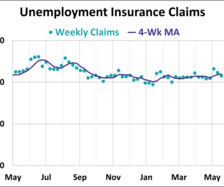

The DOL reported : In the week ending May 18, the advance figure for seasonally adjusted initial claims was 215,000 , a decrease of 8,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 222,000 to 223,000. The 4-week moving average was 219,750, an increase of 1,750 from the previous week's revised average.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

MAY 23, 2024

iCapital anticipates expanding its digital ledger technology to more funds on its platform later in the year.

Calculated Risk

MAY 23, 2024

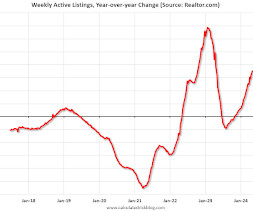

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 30.4% YoY, but still down almost 36% compared to April 2017 to 2019 levels. Now - on a weekly basis - inventory is up 35.5% YoY. Realtor.com has monthly and weekly data on the existing home market.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

MAY 23, 2024

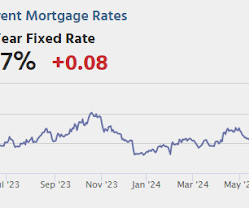

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Friday: • At 8:30 AM ET, Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.6% decrease in durable goods orders. • At 10:00 AM, University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 67.4.

Wealth Management

MAY 23, 2024

Financial advisors were split on the current state of the economy, while a majority held a positive view of the stock market in April, according to WealthManagement.com's Advisor Sentiment Index.

Calculated Risk

MAY 23, 2024

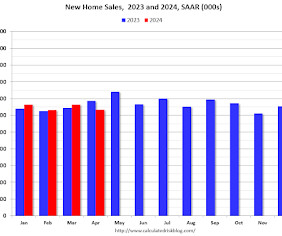

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Decrease to 634,000 Annual Rate in April Brief excerpt: Note: there were some seasonal revisions back to 2019, and significant changes to house prices and price distribution in this release. The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 634 thousand.

Wealth Management

MAY 23, 2024

After a dozen years in the wirehouse world, Reza Zamani began to recognize the limitations inherent to the model. So in 2012, he left to launch SteelPeak Wealth with $250 million in AUM. Today, it manages $3 billioon with 20 advisors on the team.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

A Wealth of Common Sense

MAY 23, 2024

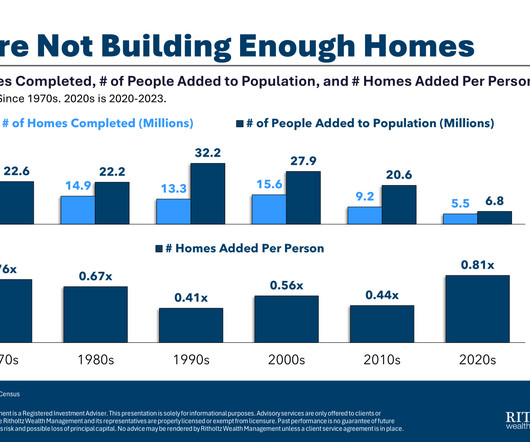

A reader asks: Do you guys really think foreign investsments and private equity really aren’t driving up housing prices? It really seems like it is. I understand the sentiment here. The housing market is broken right now for a lot of people. The blame is simply misplaced here. It’s not Blackrock or Blackstone or any other institutional investor who is causing the lack of supply in the housing market.

Wealth Management

MAY 23, 2024

Large core and large growth managers fared the best, according to Zephyr data.

Carson Wealth

MAY 23, 2024

One of the most important decisions you’ll make when designing your estate plan is who to name in the various fiduciary roles: trustee, personal representative, executor and agent. While a critical decision, it’s often given significantly less thought than the distribution of your assets. But even a meticulously designed estate plan drafted by an accomplished estate planning attorney can fail to achieve its purpose if the trustee fails to administer the trust properly.

Wealth Management

MAY 23, 2024

The United States has pushed back on a global minimum wealth tax on billionaires.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Million Dollar Round Table (MDRT)

MAY 23, 2024

By Bryce Sanders Impress your clients and score points with your manager by embracing punctuality. Here’s how it can make you stand apart from other advisors: The late start to office meetings. We have all been there. The office sets up a lunch-and-learn or a company training that’s scheduled for 1 p.m. About half the room is filled. Your sales manager says, “We will delay the start until the latecomers arrive.

Wealth Management

MAY 23, 2024

Ethereum ETFs from BlackRock, Grayscale and others are one step closer to being available on the NYSE Arca, Nasdaq and Cboe BZX exchange.

Advisor Perspectives

MAY 23, 2024

Corporate America is buying back its own shares at a near record pace, despite a new one percent buyback excise tax instituted in 2023. While buybacks are often criticized, they are wonderful for investors – though probably not in the way most people think.

Wealth Management

MAY 23, 2024

The available advocacy tools aren’t as fraught or complicated as they may seem, and the payoff for communities is huge.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

MAY 23, 2024

There’s no denying that human emotions play a role in managing money. Even someone who’s usually level-headed can get caught up in excitement, fear, or uncertainty.

Wealth Management

MAY 23, 2024

A behaviorally-oriented approach to help investors succeed.

Advisor Perspectives

MAY 23, 2024

The April release for new home sales from the Census Bureau came in at a seasonally adjusted annual rate of 634,000 units, lower than the 677,000 forecast. New home sales are down 4.7% month-over-month from a revised rate of 665,000 in March and are down 7.7% from one year ago.

Wealth Management

MAY 23, 2024

Gorman's decision to step down after giving up the CEO role in January is seen as a vote of confidence in Pick’s leadership.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

MAY 23, 2024

In the week ending May 18, initial jobless claims were at a seasonally adjusted level of 215,000, a decrease of 8,000 from the previous week's figure. The latest reading is lower than the forecast of 220,000 jobless claims.

Wealth Management

MAY 23, 2024

Issuers including Fidelity Investments and Ark Investment Management have eliminated plans for “staking” the Ether they would purchase for the proposed funds if they’re approved.

Advisor Perspectives

MAY 23, 2024

Since the pandemic-related fiscal stimulus, the outstanding Federal debt has risen appreciably. In nominal dollar terms, the recent debt surge is mindboggling. However, the increase is on par with the government’s negligence over the last fifty years.

Wealth Management

MAY 23, 2024

Unlocking the future of wealth management with tech-savvy tactics.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

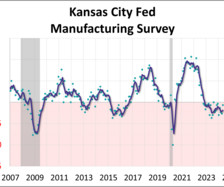

Advisor Perspectives

MAY 23, 2024

The latest Kansas City Fed Manufacturing Survey composite index increased in May as did future expectations. The composite index came in at -2, up from -8 in April, while the future outlook rose to 6.

Wealth Management

MAY 23, 2024

Engaging the next generation: Axtella's plan to revitalize finance.

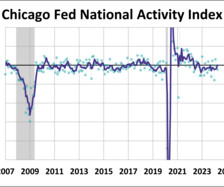

Advisor Perspectives

MAY 23, 2024

The Chicago Fed National Activity Index (CFNAI) fell to -0.23 in April from -0.04 in March. Three of the four broad categories of indicators used to construct the index decreased from March and all four categories made negative contributions in April. The index's three-month moving average, CFNAI-MA3, rose to +0.01 in April from -0.17 in March.

Wealth Management

MAY 23, 2024

Monday, June 17, 2024 | 2:00 PM Eastern Daylight Time

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content