What Impact Are Construction Delays Having on the Industrial Sector?

Wealth Management

SEPTEMBER 1, 2022

The industrial development pipeline is at its highest level in years. But developers are facing a host of new challenges.

Wealth Management

SEPTEMBER 1, 2022

The industrial development pipeline is at its highest level in years. But developers are facing a host of new challenges.

Calculated Risk

SEPTEMBER 1, 2022

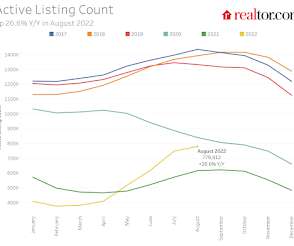

Today, in the Calculated Risk Real Estate Newsletter: Active vs Total Existing Home Inventory Excerpt: Over a year ago, housing economist Tom Lawler noted the divergence in the change in total inventory vs the change in active inventory. He wrote : As I’ve noted before, the inventory measure in most publicly-released local realtor/MLS reports excludes listings with pending contracts, but that is not the case for many of the reports sent to the NAR (referred to as the “NAR Report!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 1, 2022

Skeptics of the meme-craze that’s re-ignited corners of the stock market may soon have a fresh way to bet against it.

Calculated Risk

SEPTEMBER 1, 2022

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 52.8% in August, unchanged from 52.8% in July. The employment index was at 54.2%, up from 49.9% last month, and the new orders index was at 51.3%, up from 48.0%. From ISM: Manufacturing PMI® at 52.8% August 2022 Manufacturing ISM® Report On Business® Economic activity in the manufacturing sector grew in August, with the overall economy achieving a 27th consecutive month of growth, say the nation's supply e

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

SEPTEMBER 1, 2022

Learn about the evolving nature of acquisitions.

Calculated Risk

SEPTEMBER 1, 2022

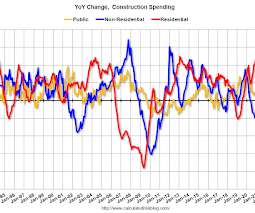

From the Census Bureau reported that overall construction spending increased: Construction spending during July 2022 was estimated at a seasonally adjusted annual rate of $1,777.3 billion, 0.4 percent below the revised June estimate of $1,784.3 billion. The July figure is 8.5 percent above the July 2021 estimate of $1,637.3 billion. emphasis added Private spending decreased and public spending increased: Spending on private construction was at a seasonally adjusted annual rate of $1,424.2 billio

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

SEPTEMBER 1, 2022

Strategy There's still too much closet indexing going on. (ft.com) People who get out of the market have a hard time getting back in. (evidenceinvestor.com) Companies Netflix ($NFLX) is planning to charge premium rates for ads. (wsj.com) Snap ($SNAP) simply overhired during pandemic. (theinformation.com) How a Twitter ($TWTR) edit button can be abused.

Wealth Management

SEPTEMBER 1, 2022

Explosive growth in the advisor industry has strained ancillary services, especially in the custodial space.

The Reformed Broker

SEPTEMBER 1, 2022

Final Trades: CME, Abbvie & more from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

SEPTEMBER 1, 2022

The company has “no issue” when employees need to work from home from time to time, though it wants senior bankers to be coming in to motivate their junior counterparts, according to a memo to staff. The memo follows similar moves from banks including Goldman Sachs Group Inc. and Morgan Stanley in recent days.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

SEPTEMBER 1, 2022

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill: We estimate nonfarm payrolls rose by 350k in August (mom sa). We estimate the unemployment rate edged down to 3.4% in August. emphasis added CR Note: The consensus is for 280 thousand jobs added, and for the unemployment rate to be unchanged at 3.5%.

Wealth Management

SEPTEMBER 1, 2022

Thursday, September 22, 2022 | 4:15 PM ET

Abnormal Returns

SEPTEMBER 1, 2022

Books An excerpt from "How to Stay Smart in a Smart World: Why Human Intelligence Still Beats Algorithms" by Gerd Gigerenzer. (behavioralscientist.org) An excerpt from "Streets of Gold: America’s Untold Story of Immigrant Success" by Ran Abramitzky and Leah Boustan. (behavioralscientist.org) An excerpt from Marisa Franco’s new book, "Platonic: How the Science of Attachment Can Help You Make—And Keep—Friends.

Wealth Management

SEPTEMBER 1, 2022

These funds saw the most activity over the past 30 days.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

SEPTEMBER 1, 2022

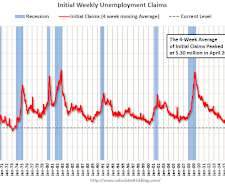

The DOL reported : In the week ending August 27, the advance figure for seasonally adjusted initial claims was 232,000 , a decrease of 5,000 from the previous week's revised level. The previous week's level was revised down by 6,000 from 243,000 to 237,000. The 4-week moving average was 241,500, a decrease of 4,000 from the previous week's revised average.

A Wealth of Common Sense

SEPTEMBER 1, 2022

A reader asks: Recently my father passed away leaving roughly $150k to me as an inheritance and I’m trying to figure out if I should save or invest it. I’m 26 years old and served 4 years as an army officer. I will be separating honorably soon where I’ll go back to school and may need to access these funds. I also may use them to buy a future house or get married.

Validea

SEPTEMBER 1, 2022

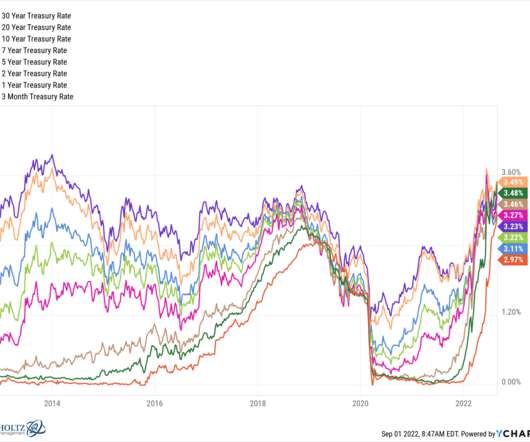

Minneapolis Fed President Neil Kashkari told Bloomberg that he was “happy to see” the reaction to Jerome Powell’s speech at the Fed’s annual retreat in Jackson Hole, in an interview on Bloomberg’s Odd Lots podcast. That reaction was a steep market drop in the wake of the speech, indicating investors are starting to comprehend the Fed’s battle to get inflation back to 2%.

Pragmatic Capitalism

SEPTEMBER 1, 2022

I joined The Investor’s Podcast for the 9th time! I am officially the Alec Baldwin of the show, but far less handsome. We continued our talk about inflation and how [ … ].

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

NAIFA Advisor Today

SEPTEMBER 1, 2022

Life insurance is a crucial part of any solid financial plan, but 41% of Americans say they don’t have sufficient life insurance coverage. That's why NAIFA partner Life Happens created Life Insurance Awareness Month (LIAM) and why NAIFA strongly supports efforts to promote the benefits of life insurance during September and all year long. For agents and advisors, LIAM is the perfect time to meet with your clients to make sure their life insurance coverage meets their needs.

WiserAdvisor

SEPTEMBER 1, 2022

If you are thinking about why you should continue meeting with your financial advisor, you have already taken a big step toward securing your financial future – you have engaged the services of a professional. Now, how often you need to meet with your advisor depends on the degree of help needed by you. If your financial affairs are complex in nature that require a higher frequency of supervision such as overseeing an estate, sale of a real estate property, having multiple investments acro

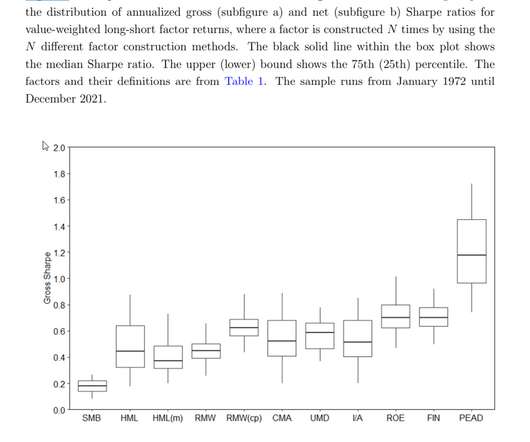

Alpha Architect

SEPTEMBER 1, 2022

Non-standard errors capture uncertainty due to differences in research design choices. We establish substantial variation in the design choices made by researchers when constructing asset pricing factors. By purposely data mining over two thousand different versions of each factor, we find that Sharpe ratios exhibit substantial variation within a factor due to different construction choices, which results in sizable non-standard errors and allows for p-hacking.

Validea

SEPTEMBER 1, 2022

2022’s second quarter saw a record high for global dividends, after payouts that were delayed by the pandemic rebounded, reports an article in Barron’s. According to the most recent version of the Janus Henderson Global Dividend Index, which tracks payouts from 1200 companies around the globe, dividends shot up to $545 billion or 11.3%. That’s an all-time record.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Clever Girl Finance

SEPTEMBER 1, 2022

Are you a victim of your limiting beliefs about money? You're not alone. According to a new report , 50% of Americans say they feel at least somewhat trapped in their financial situation. Seventeen percent feel very or extremely trapped. When you feel stuck in your financial situation, it can be hard to learn how to make a change and move forward—and it's depressing and disheartening.

Validea

SEPTEMBER 1, 2022

Market performance in the early years of retirement can greatly affect how long retirement funds will last, as losses can take a larger chunk out of a portfolio when it’s more flush. In an ideal world, every retiree would time their retirement to coincide with a bull market, but even during a severe downturn retirees can make their money last, contends an article in The Wall Street Journal.

SEI

SEPTEMBER 1, 2022

Video Q&A: Trends in cryptocurrency fundraising. phernandez1. Thu, 09/01/2022 - 09:18. 2 minutes. Alternative investments. Nonprofits and healthcare organizations. Institutional (US). Video. Our insights. Cryptocurrency appears to be here to stay. In fact, one in 10 people in the U.S. are already investing in cryptocurrencies, especially among our millennial and Generation Z investors.

Validea

SEPTEMBER 1, 2022

There has been a lot of debate about Federal Reserve policy in the wake of the pandemic. But many of those involved in that debate want to promote a specific position and interpret the facts in a way to accomplish that goal. In this episode, we wanted to take a step back cover the facts about the Federal Reserve and how it operates. And we couldn’t think of a better person to do that with than our friend Cullen Roche.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

SEI

SEPTEMBER 1, 2022

CEO statement on DEI. emudrock1. Thu, 09/01/2022 - 12:14. 2 minutes. Community. Culture. Corporate. Enterprise (Corporate). Video. Inclusion. Our leadership is launching a multi-year initiative to continue improving diverse representation throughout our workforce. View transcript. Close transcript. We have always believed in the power of diversity, equity, and inclusion (DEI) to fuel our approach to creating solutions for new challenges, making better decisions, and providing every employee acce

Validea

SEPTEMBER 1, 2022

September has a long history of being the worst month for stocks, averaging a 0.56% decline in the S&P 500 (and its predecessor) since the end of WWII, according to an article in Chief Investment Officer that cites a study by Sam Stovall of CFRA. Small-cap stocks usually get hit along with large-cap stocks in the S&P 500, with the Russell 2000 declining 0.31% on average in September.

SEI

SEPTEMBER 1, 2022

CEO statement on diversity. emudrock1. Thu, 09/01/2022 - 12:14. 2 minutes. Community. Culture. Corporate. Enterprise (Corporate). Video. Inclusion. Our leadership is launching a multi-year initiative to continue improving diverse representation throughout our workforce. View transcript. Close transcript. We have always believed in the power of diversity, equity, and inclusion (DEI) to fuel our approach to creating solutions for new challenges, making better decisions, and providing every employe

Advisor Websites

SEPTEMBER 1, 2022

Your website is more than just your digital business card, it's the focal point of your marketing strategy.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content