The New 60/40? Public Vs. Private

Wealth Management

MAY 21, 2023

The portfolio of the future will be crafted around exposure to public versus private markets, according to speakers at the Wealth Management EDGE conference.

Wealth Management

MAY 21, 2023

The portfolio of the future will be crafted around exposure to public versus private markets, according to speakers at the Wealth Management EDGE conference.

Abnormal Returns

MAY 21, 2023

Top clicks this week 10 things we get rid of as we age. (physicianonfire.com) Money buys independence: the 16 levels of wealth. (collabfund.com) People looking to buy a house right now have three options. (awealthofcommonsense.com) A big wealth transfer is under way in the U.S. (nytimes.com) Copper prices have rolled over. (allstarcharts.com) What does it really cost to own a home?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 21, 2023

During a panel at the WealthManagement EDGE conference, the head of Mango Digital Strategies worried CEOs of crypto exchanges may opt to move to international locations trying to position themselves as crypto hubs.

Abnormal Returns

MAY 21, 2023

Markets Ten bad market takes including 'Recession is inevitable?' (ritholtz.com) 10 charts this week including the surge in Nvidia ($NVDA). (bilello.blog) Strategy Why so many Americans think their house is the best investment. (awealthofcommonsense.com) Every investment plan needs some room for error. (humbledollar.com) Finance How much bigger can JP Morgan Chase ($JPM) get?

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

MAY 21, 2023

Mike Durso spoke with Louis Diamond at RIA Edge about leaving Morgan Stanley to launch an RIA with support from Dynasty Financial Partners.

Calculated Risk

MAY 21, 2023

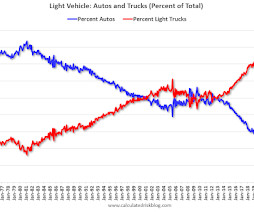

The first graph below shows the mix of sales since 1976 (Blue is cars, Red is light trucks and SUVs) through April 2023. Click on graph for larger image. The mix has changed significantly. Back in 1976, most light vehicles were passenger cars - however passenger car sales have trended down over time. Note that the big dips in sales are related to economic recessions (early '80s, early '90s, the Great Recession of 2007 through mid-2009 and the pandemic in 2020).

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

MAY 21, 2023

Weekend: • Schedule for Week of May 21, 2023 Monday: • No major economic releases scheduled. From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 8 and DOW futures are down 58 (fair value). Oil prices were up over the last week with WTI futures at $71.55 per barrel and Brent at $75.58 per barrel. A year ago, WTI was at $113, and Brent was at $114 - so WTI oil prices are down about 37% year-over-year.

A Wealth of Common Sense

MAY 21, 2023

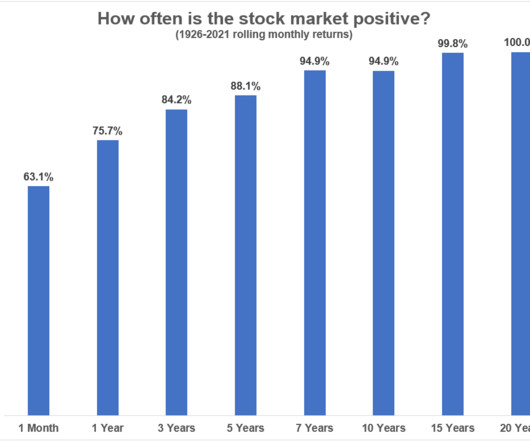

The Financial Times had a story this week about Carl Icahn’s bets against the stock market that went awry. Since 2017, Icahn has been positioning part of his portfolio for a huge crash. It cost him nearly $9 billion over the past 6 years. Sounds like a lot. Here’s what he told the Times: “I’ve always told people there is nobody who can really pick the market on a short-term or an intermediate-term basis,�.

Million Dollar Round Table (MDRT)

MAY 21, 2023

By Jeffrey Scott, CFP, ChFC We sell an intangible asset that is nothing more than a promise to pay a particular amount at a specific point in time. We must convince our clients of the importance of life insurance in their individual lives. Here’s how we can do that. The client value proposition Most people can state what they do in their jobs, but very few people can tell you what they believe.

The Irrelevant Investor

MAY 21, 2023

On today’s special edition of Animal Spirits, we are joined by Ramit Sethi to discuss his new Netflix Show, How to Get Rich. On today’s show, we discuss: How to live a rich life Spending money on important things Ramits Netflix expereince Personal finance in early education Figuring out what a rich life means to you Relationships and money Biggest surprise about filming a show Listen here: Charts: Follow.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

oXYGen Financial

MAY 21, 2023

The Irrelevant Investor

MAY 21, 2023

Today’s Talk Your Book is presented by GLASfunds: On today’s show, we are joined by Brett Hillard, CIO of GLASfunds to discuss revolutionizing the alternative investment process for advisors. On today’s show, we discuss: The GLASfunds origin story Issues advisors have investing in privates and alts The fund manager due diligence process How the GLASfund fee works for advisors Getting advisors comfortable with.

Trade Brains

MAY 21, 2023

Best Large Cap Stocks Under Rs 100 : The most thrilling experience, understood globally, is getting more for less. More value, less expense. More quality, less price. And in terms of investments, more quantity, less price. Not to mention affordability, making it more appealing to more investors. What are investors’ options when they want to invest in established companies, without breaking the bank for each share?

The Big Picture

MAY 21, 2023

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • The War on Poverty Is Over. Rich People Won. The sociologist Matthew Desmond believes that being poor is different in the U.S. than in other rich countries. How is poverty different in America than in its peer countries? Matthew Desmond: We have more of it. We have double the child-poverty rate of Germany and South Korea.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Let's personalize your content