Schedule for Week of September 1, 2024

Calculated Risk

AUGUST 31, 2024

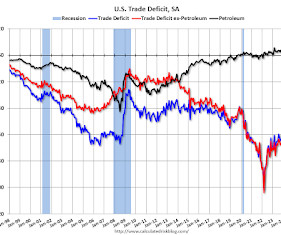

I'll be out of contact from August 20th until Sept 4th. I'll be back for the August employment report. The key report this week is the August employment report on Friday. Other key indicators include the August ISM manufacturing index, August auto sales, and Trade Deficit for July. -- Monday, September 2nd -- All US markets will be closed in observance of the Labor Day holiday. -- Tuesday, September 3rd -- 10:00 AM: ISM Manufacturing Index for August. 10:00 AM: Construction Spending for July.

Let's personalize your content