MBA: Mortgage Applications Increased in Weekly Survey

Calculated Risk

AUGUST 7, 2024

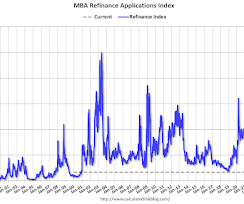

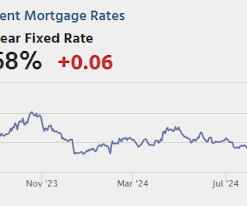

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 6.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending August 2, 2024. The Market Composite Index, a measure of mortgage loan application volume, increased 6.9 percent on a seasonally adjusted basis from one week earlier.

Let's personalize your content