AI Solutions Are Making Strides In Fintech Land

Wealth Management

AUGUST 9, 2022

Products like Toggle, though hardly revolutionary, nonetheless represent significant steps forward in improving day-to-day efficiency for advisors.

Wealth Management

AUGUST 9, 2022

Products like Toggle, though hardly revolutionary, nonetheless represent significant steps forward in improving day-to-day efficiency for advisors.

Calculated Risk

AUGUST 9, 2022

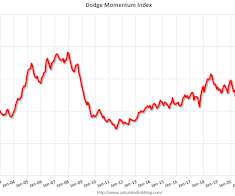

From Dodge Data Analytics: Dodge Momentum Index Moves Higher In July The Dodge Momentum Index (DMI) increased 2.9% in July to 178.7 from the revised June figure of 173.6. The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning. The index is shown to lead construction spending for nonresidential buildings by a full year.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 9, 2022

Like it or not, you are in the digital space. Here’s how to start using it to your advantage.

Nerd's Eye View

AUGUST 9, 2022

Welcome back to the 293rd episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Anna N’Jie-Konte. Anna is the founder of Dare to Dream Financial Planning, an independent RIA based in New York City that has grown to more than $400,000 of annual revenue in barely 3 years by building a focused base of 32 ongoing clients coupled with more than a dozen project-based planning clients who go through a one-day financial planning intensive.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 9, 2022

Cap rates on suburban garden apartments fell below rates for mid-rise and high-rise multifamily properties during the second quarter, according to recent data from MSCI-Real Estate.

Abnormal Returns

AUGUST 9, 2022

Cryptocurrencies A study of the personality traits of cryptocurrency buyers. (evidenceinvestor.com) On the flaws of the Bitcoin model, at scale. (papers.ssrn.com) Research Is it possible to identify when momentum crashes are more likely to happen? (alphaarchitect.com) Why does trend following work better in a high inflation regime? (mrzepczynski.blogspot.com) There's not much to see in tactical asset allocation ETF performance.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 9, 2022

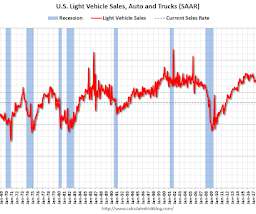

Back in early 2009, I wrote a couple of posts arguing there would be an increase in auto sales - Vehicle Sales (Jan 2009) and Looking for the Sun (Feb 2009). This was an out-of-the-consensus call and helped me call the bottom for the US economy in mid-2009. I wrote an update in 2014 , and argued vehicle sales would "mostly move sideways" for the next few years.

Wealth Management

AUGUST 9, 2022

While representatives of the Institute for Portfolio Alternatives warn of the proposal’s 'chilling effect' on brokers, state regulators are asking why REIT customer complaints remain elevated.

A Wealth of Common Sense

AUGUST 9, 2022

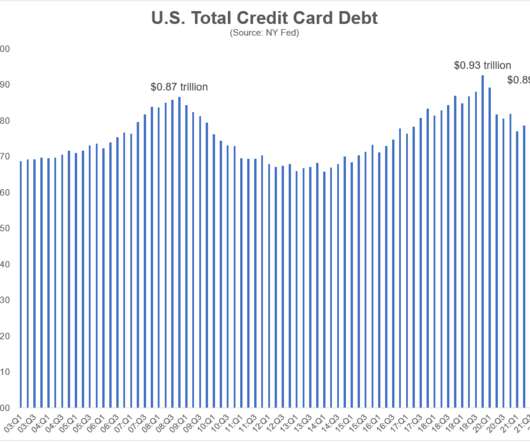

Consumer debt is on the rise. This comes from a recent report by the New York Fed: Total household debt rose $312 billion, or 2 percent, in the second quarter of 2022 to reach $16.15 billion, according to the latest?Quarterly Report on Household Debt and Credit. Mortgage balances—the largest component of household debt—climbed $207 billion and stood at $11.39 trillion as of June 30.

Wealth Management

AUGUST 9, 2022

Which U.S. life sciences markets are seeing the most tenant demand? A new CBRE report takes a close look at statistics.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Reformed Broker

AUGUST 9, 2022

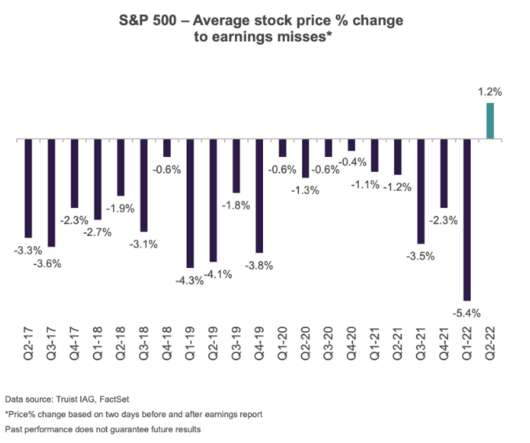

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ?Was that it? – Epic bounce. Stopped at Vix 20 and reversed. Pattern still holds. ?Expecting worse – “S&P 500 – Average stock price % change to earnings misses*” ?

Wealth Management

AUGUST 9, 2022

If legislative action follows a blueprint established decades ago by the biotechnology industry, it can help fuel innovation and encourage continued adoption.

The Reformed Broker

AUGUST 9, 2022

Final Trades: Goldman Sachs, Intl. Flavors & more from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

AUGUST 9, 2022

A recent capital infusion from LNC Partners will support continued growth for GCG Advisory Partners as a newly incorporated holding company focused on advisor succession.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Abnormal Returns

AUGUST 9, 2022

Strategy Why we find it so hard to withstand a bear market. (theirrelevantinvestor.com) Ten things investors are bad at including 'Withstand poor performance.' (behaviouralinvestment.com) Companies AMC ($AMC) keep playing to the retail crowd. (hollywoodreporter.com) Signs that the CHIPS Act is already working. (bloomberg.com) ETFs Fees matter, a lot, when it comes to ETF flows.

Wealth Management

AUGUST 9, 2022

At RIAs, they’re an indispensable way to find out more about potential hires than what’s just on a resume.

Calculated Risk

AUGUST 9, 2022

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in July A brief excerpt: This is the first look at local markets in July. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Wealth Management

AUGUST 9, 2022

Investors are jumping at opportunities to buy land in Sun Belt cities, reports The Wall Street Journal. Politico looks at the groups that lobby for retaining the carried interest loophole. These are among today’s must reads from around the commercial real estate industry.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

The Irrelevant Investor

AUGUST 9, 2022

90% of stocks in the Russell 1000 are up since June 16th, the day the market bottomed. Some themes stand out when you take a closer look at the winners and losers. 4% of stocks are up 50% or more since the bottom, and a quick glance at this list reveals a common theme; these names all got massacred. Carvana is up over 100% since the bottom and is still down 88% over the past year.

Wealth Management

AUGUST 9, 2022

While representatives of the Institute for Portfolio Alternatives warn of the proposal’s “chilling effect” on brokers, state regulators are asking why REIT customer complaints remain elevated.

The Irrelevant Investor

AUGUST 9, 2022

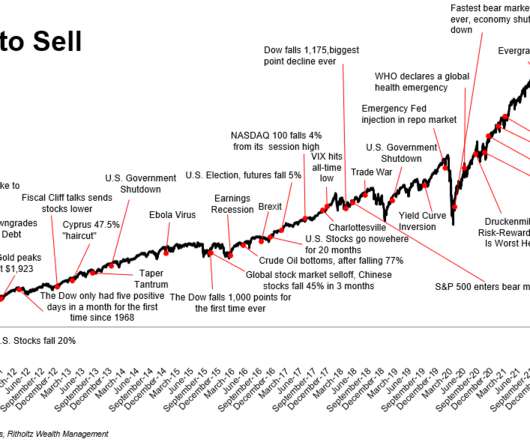

Are you struggling to come up with the bull case right now? Finding reasons to be optimistic is a challenge that never goes away. I remember when the Roosevelt Raceway theater came to Long Island in 1995. I was ten years old when it felt like Disney World opened up in my backyard. This state-of-the-art cineplex was home to arcade games and a couple of big screen TVs that would run coming attractions on repeat.

Wealth Management

AUGUST 9, 2022

Efforts to address gender inequities in investing are falling short, largely because financial institutions still can’t shake old stereotypes.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Alpha Architect

AUGUST 9, 2022

Standardized Performance. Factor Performance. Factor Exposures. Factor Premiums. Factor Attribution. Factor Data Downloads. Global Factor Performance: August 2022 was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

AUGUST 9, 2022

Direxion and GraniteShares are each launching four exchange-traded funds that allow investors to make leveraged or inverse bets on the daily performance of individual companies.

NAIFA Advisor Today

AUGUST 9, 2022

The National Association of Insurance and Financial Advisors (NAIFA) is proud to announce its participation in The American College of Financial Services' sixteenth annual Conference of African American Financial Professionals. The event is being held at the Omni Shoreham Hotel in Washington, D.C. this week and is attended by many NAIFA members and association partners.

Wealth Management

AUGUST 9, 2022

Residents in popular neighborhoods say they’re being forced to agree to rent hikes of as much as 40 percent and contract periods stretching two years.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Million Dollar Round Table (MDRT)

AUGUST 9, 2022

By Antoinette Tuscano, MDRT Content Specialist In this internet age, before clients do business with you, they go online to find who you are, what your business is and why you might care about doing your best for them. When researching online, your “About us” webpage is often one of the first places people visit. Have you looked at your “About us” page lately?

Wealth Management

AUGUST 9, 2022

An inversion has preceded every recession since the 1950s, but this time a downturn may not be inevitable.

The Irrelevant Investor

AUGUST 9, 2022

Today’s Animal Spirits is brought to you by Masterworks: See here to learn more about investing in contemporary art. On today’s show we discuss: Does this look like a recession to you? H1 was not a recession Uptick in home searches and tours Home listings are stale Softbank taking major losses HOOD earnings Z earnings OPEN earnings UBER earnings AMC earnings NVDA earnings Robinhood laying off 23% of workfo.

Wealth Management

AUGUST 9, 2022

The real game changer is blockchain technology, says Jenny Johnson.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content