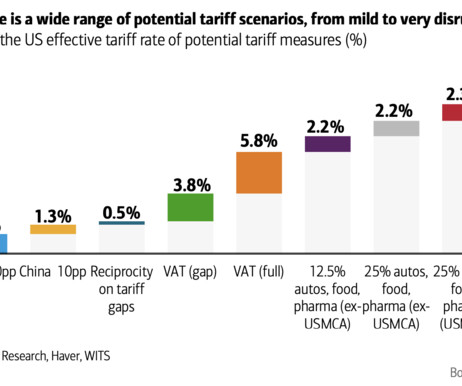

Are Tariffs a New US VAT Tax?

The Big Picture

MARCH 31, 2025

A quick note on tariffs : Over the past few weeks, I’ve been putting together my quarterly call for clients. The challenge is how to frame the current economic scenario in a way that is useful and informative and not the usual run-of-the-mill noise. Its easy to get distracted by the chaos of random policies that have been coming rapid-fire at Americans.

Let's personalize your content