The Estate Tech Revolution Is Picking Up Speed

Wealth Management

MAY 30, 2024

Vanilla and Wealth.com are among the early frontrunners, but the field of contenders is increasingly crowded—and diverse.

Wealth Management

MAY 30, 2024

Vanilla and Wealth.com are among the early frontrunners, but the field of contenders is increasingly crowded—and diverse.

Calculated Risk

MAY 30, 2024

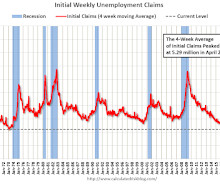

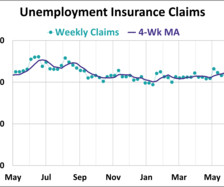

The DOL reported : In the week ending May 25, the advance figure for seasonally adjusted initial claims was 219,000 , an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 215,000 to 216,000. The 4-week moving average was 222,500, an increase of 2,500 from the previous week's revised average.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 30, 2024

“We see the broad RIA community as a very attractive client base for Goldman Sachs,” according to President and COO John E. Waldron.

Calculated Risk

MAY 30, 2024

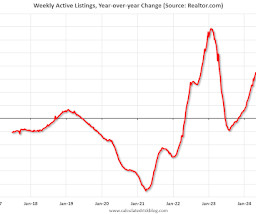

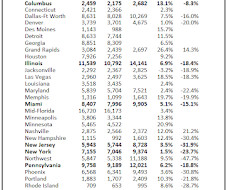

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 30.4% YoY, but still down almost 36% compared to April 2017 to 2019 levels. Now - on a weekly basis - inventory is up 36.5% YoY. Realtor.com has monthly and weekly data on the existing home market.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

MAY 30, 2024

The Horizon Group, a team of five advisors and four branch professionals, joins Pinnacle Asset Management, an affiliated bank branch, from Truist.

Abnormal Returns

MAY 30, 2024

Markets Trading in Nvidia ($NVDA) shares dwarf other large companies. (sherwood.news) The 0DTE market just keeps growing. (ft.com) Strategy How much to allocate to private equity, if you must. (morningstar.com) Pay less attention to your investments. (timharford.com) Crypto Gemini customers are finally going to start getting their money back. (cnbc.com) Signs that a Mt.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

MAY 30, 2024

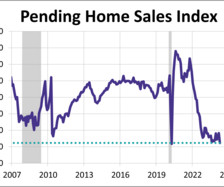

From the NAR: Pending Home Sales Slumped 7.7% in April Pending home sales in April fell 7.7% , according to the National Association of REALTORS®. All four U.S. regions registered month-over-month and year-over-year decreases. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – decreased to 72.3 in April.

Wealth Management

MAY 30, 2024

Salomon & Ludwin has filed a lawsuit against former employees who launched Founders Grove Wealth Partners, claiming they breached employment contracts and stole trade secrets.

Calculated Risk

MAY 30, 2024

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in April and a Look Ahead to May Sales A brief excerpt: In April, sales in these markets were up 7.6% YoY. In March, these same markets were down 10.0% year-over-year Not Seasonally Adjusted (NSA). Sales in most of these markets are down compared to January 2019.

Wealth Management

MAY 30, 2024

Mike Dolberg describes how he and the team at Apollon recognized the value of culture, partnership, and the freedom to serve clients—and how that realization ultimately drove their growth from $120 million in assets to $7.5 billion.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Calculated Risk

MAY 30, 2024

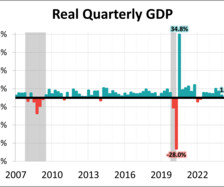

From the BEA: Gross Domestic Product, First Quarter 2024 (Second Estimate) and Corporate Profits (Preliminary) Real gross domestic product (GDP) increased at an annual rate of 1.3 percent in the first quarter of 2024, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2023, real GDP increased 3.4 percent.

Wealth Management

MAY 30, 2024

Bridget Venus Grimes, founder of WealthChoice and co-founder of Equita Financial Network, explains how her $90 million AUM firm uses its tech stack to help women tech workers, attorneys, founders and business owners navigate financial challenges.

Calculated Risk

MAY 30, 2024

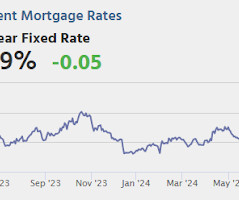

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Friday: • At 8:30 AM ET, Personal Income and Outlays, April 2024. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.7% YoY, and core PCE prices up 2.8% YoY. • At 9:45 AM, Chicago Purchasing Managers Index for May.

Wealth Management

MAY 30, 2024

Apollo’s products for individual investors are distributed through intermediaries such as bank wealth channels and registered investment advisers, and the firm doesn’t expect that to change.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Advisor Perspectives

MAY 30, 2024

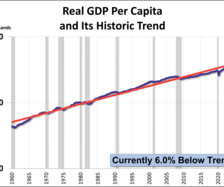

The U.S. economy grew at a slower than expected pace to start off the year. Real gross domestic product increased at an annual rate of 1.3% in Q1 2024, according to the second estimate. The latest estimate is lower than the forecasted 1.6% growth and is a slowdown from the Q4 2023 GDP final estimate of 3.4%.

Wealth Management

MAY 30, 2024

Portsmouth Financial Services will continue to do business under its original name, with Chairman Ray Lent and CEO Echo Chien also remaining onboard.

A Wealth of Common Sense

MAY 30, 2024

We also discussed questions about inequality, the number of credit cards one should have, the value of a low-rate mortgage, and how to pay for IVF. Further Reading: 7 Benefits of Writing The post How to Start a Newsletter appeared first on A Wealth of Common Sense.

Wealth Management

MAY 30, 2024

The latest fundraising marks the fifth iteration of the firm’s Loan Partners fund, a series that got off the ground in 2008.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Advisor Perspectives

MAY 30, 2024

The second estimate for Q1 GDP came in at 1.25%, a deceleration from 3.40% for the Q4 final estimate. With a per-capita adjustment, the headline number is lower at 0.79%, a decrease from 2.79% for the Q4 headline number.

Wealth Management

MAY 30, 2024

Iqbal Khan, who previously had sole charge of the key wealth unit, will now also become president of the Asia Pacific region.

Nerd's Eye View

MAY 30, 2024

Over the past couple of decades, the financial advice industry has seen a tremendous shift as the focus has evolved away from being primarily transaction-based and towards forming long-term service-based relationships with clients. Yet, one of the hurdles advicers have faced along the way is figuring out how to demonstrate the seemingly intangible value of financial planning as a service.

Advisor Perspectives

MAY 30, 2024

In spite of the highest Federal Reserve policy rates in two decades, the US economy grew about 2.5% last year, unemployment remains low and stocks are near all-time highs, leading many observers to conclude that the economy must have become less interest-rate sensitive — and probably needs permanently high benchmark rates to prevent overheating.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Better Letter

MAY 30, 2024

Welcome (or welcome back). If you’re new here, check out these TBL “greatest hits” below. Rhyming Set to Music The Index Mindset Addition By Subtraction Words to Live By If you like The Better Letter , please subscribe, share it, and forward it widely. Subscribe now Share The Better Letter Get more from Bob Seawright in the Substack app Available for iOS and Android Get the app NOTE: Some email services may truncate TBL.

Advisor Perspectives

MAY 30, 2024

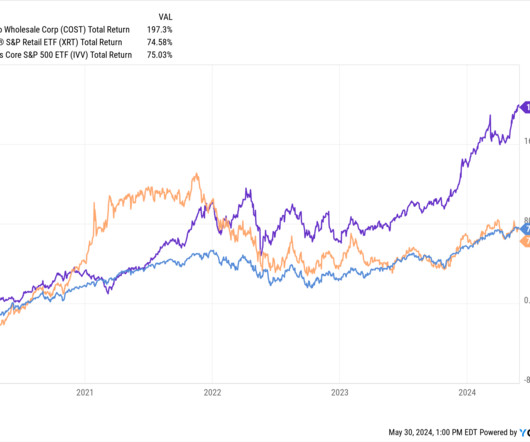

The semiconductor industry is a strange field. Play your cards right, and you can turn $60 billion or so of annual revenue into a $2.62 trillion business. Do things differently, and roughly the same volume of sales might translate into $44 billion of market capitalization.

Trade Brains

MAY 30, 2024

Fundamental Analysis Of Vedanta: The mining and metals industry stands as a cornerstone of global economic development, catering to a multitude of sectors, from infrastructure to technology. Within this dynamic landscape, Vedanta emerges as a key player, renowned for its diversified portfolio encompassing zinc, lead, silver, copper, iron ore, aluminum, and oil & gas.

Advisor Perspectives

MAY 30, 2024

America’s political leaders have resorted to playing the blame game to convince voters that they are fixing the country’s trade deficit. But by going after China, they are ignoring the root of the problem – the American government’s unchecked spending – while increasing the risk of a full-blown superpower conflict.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

SEI

MAY 30, 2024

Every financial decision seems to introduce new uncertainties. Moving forward confidently means addressing these challenges head on. We start with four questions.

Advisor Perspectives

MAY 30, 2024

The National Association of Realtors® (NAR) released the latest monthly data for its pending home sales index. The index slumped 7.7% in April to 72.3, its lowest level since April 2020 and more than the forecasted 1.1% decline. Pending home sales are down 7.4% from one year ago.

Inside Information

MAY 30, 2024

This issue of Inside Information represents the mission of the publication, and my mission as a writer in the profession. Each article invites our readers to rethink client service, investing and advice in new and better ways. Better? Over the years, I’ve been privileged to witness a long, positive evolution, an evolution where financial planners offered increasingly more valuable advice to their clients, and used better tools to supplement it.

Advisor Perspectives

MAY 30, 2024

In the week ending May 25, initial jobless claims were at a seasonally adjusted level of 219,000, an increase of 3,000 from the previous week's figure. The latest reading is higher than the forecast of 218,000 jobless claims.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Let's personalize your content