Heavy Truck Sales Solid in August, Up 2% YoY

Calculated Risk

SEPTEMBER 5, 2023

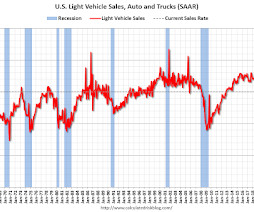

The BEA released their estimate of vehicle sales for August today. This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the August 2023 seasonally adjusted annual sales rate (SAAR). Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Let's personalize your content