Heckenberg’s New PE Firm Makes First Investment in $2.6B AlphaCore Wealth Advisory

Wealth Management

DECEMBER 5, 2023

Constellation Wealth Capital has purchased a minority stake in AlphaCore Wealth, an alts-focused, technology-driven California RIA.

Wealth Management

DECEMBER 5, 2023

Constellation Wealth Capital has purchased a minority stake in AlphaCore Wealth, an alts-focused, technology-driven California RIA.

Calculated Risk

DECEMBER 5, 2023

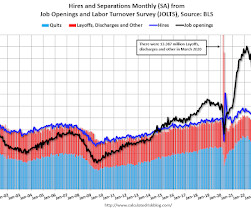

From the BLS: Job Openings and Labor Turnover Summary The number of job openings decreased to 8.7 million on the last business day of October , the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations changed little at 5.9 million and 5.6 million, respectively. Within separations, quits (3.6 million) and layoffs and discharges (1.6 million) changed little. emphasis added The following graph shows job openings (black line), hires (dark blue), L

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

DECEMBER 5, 2023

The alts-focused investment manager reorganizes to expand affiliation options and welcomes three recruits with more than $560 million in assets.

Calculated Risk

DECEMBER 5, 2023

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA). From CoreLogic: US Home Price Growth Continues Slow But Steady Increase in October, CoreLogic Reports • U.S. single-family home prices increased by 4.7% year over year in September, the 141st straight month of annual appreciation. • CoreLogic projects that annual home price growth will rel

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

DECEMBER 5, 2023

Commonwealth's PPS Select Compass is intended to provide advisors with more control and flexibility in portfolio construction.

Calculated Risk

DECEMBER 5, 2023

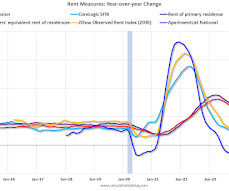

Today, in the Calculated Risk Real Estate Newsletter: Asking Rents Down 1.1% Year-over-year A brief excerpt: Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through October 2023, except CoreLogic is through September and Apartment List is through November 2023. The CoreLogic measure is up 2.6% YoY in September, down from 2.9% in August, and down from a peak of 13.9% in April 2022.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

DECEMBER 5, 2023

Active management Active investing has a tax problem. (alphaarchitect.com) Why the active management space may be bigger than currently measured. (papers.ssrn.com) Replication Managed futures strategies are ripe for replication. (caia.org) How to replicate fund performance using index and smart beta funds. (insights.finominal.com) Factors What happened to the momentum effect?

Wealth Management

DECEMBER 5, 2023

MarshBerry’s Rob Madore shares strategies for growth, succession and the recent shift in how RIAs are approaching mergers and acquisitions.

Nerd's Eye View

DECEMBER 5, 2023

Welcome back to the 362nd episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Jeff Brown. Jeff is the President of Stratos Private Wealth, an RIA based in San Diego, California, that oversees almost $1.5 billion in assets under management for just over 350 client households. What's unique about Jeff, though, is how his firm has developed associate advisor compensation plans and career tracks, with well-defined Level 1, Level 2, and Level 3 performance indicators of

Wealth Management

DECEMBER 5, 2023

The CEOs of Yieldstreet and Cadre talked to Fortune about how the acquisition came together. Private debt and equity options geared for accredited investors continue to proliferate. These are among the must reads from the real estate investment world.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Calculated Risk

DECEMBER 5, 2023

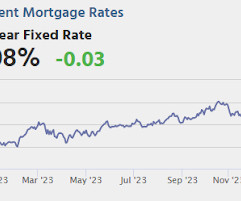

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:15 AM, The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 120,000 jobs added, up from 113,000 in October. • At 8:30 AM, Trade Balance report for October from the Census Bureau.

Wealth Management

DECEMBER 5, 2023

Reps with UBS' Athletes and Entertainers Group will provide “holistic” financial advice to prepare athletes for their post-NFL careers. Other firms with the designation include Goldman Sachs and Morgan Stanley.

The Big Picture

DECEMBER 5, 2023

The transcript from this week’s, MiB: Michael Fisch, American Securities , is below. You can stream and download our full conversation, including any podcast extras, on Apple Podcasts , Spotify , YouTube , and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here. ~~~ 00:00:00 [Speaker Changed] This is Masters in business with Barry Ritholtz on Bloomberg Radio. 00:00:07 [Barry Ritholtz] This week on the podcast, I have an extra special guest.

Wealth Management

DECEMBER 5, 2023

The new rule gives more time for companies created in 2024 to file initial beneficial ownership reports.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Calculated Risk

DECEMBER 5, 2023

(Posted with permission). The ISM® Services index was at 52.7%, up from 51.8% last month. The employment index increased to 50.7%, from 50.2%. Note: Above 50 indicates expansion, below 50 in contraction. From the Institute for Supply Management: Services PMI® at 52.7% November 2023 Services ISM® Report On Business® Economic activity in the services sector expanded in November for the 11th consecutive month as the Services PMI® registered 52.7 percent , say the nation's purchasing and supply exec

Wealth Management

DECEMBER 5, 2023

The vehicle, with a specialty in assisted living and memory care properties, aims to eventually be accessible to both accredited and non-accredited investors.

A Wealth of Common Sense

DECEMBER 5, 2023

These were some of the prevailing narratives from the post-GFC world: We only had a bull market in the 2010s because of the Fed juicing the economy. The only reason tech stocks did well is because of low interest rates. The only reason stocks kept recovering from every correction so quickly is because of the Fed put. These narratives all have a kernel of truth to them.

Wealth Management

DECEMBER 5, 2023

Insights from Nidhi Gupta, portfolio manager at Fidelity Investments, on identifying attractively valued stocks, leveraging global research, and navigating market environments for long-term portfolio growth.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Advisor Perspectives

DECEMBER 5, 2023

Don’t waste your money on lead-generation programs, white-label content, or consultants who overpromise and fail to deliver.

Wealth Management

DECEMBER 5, 2023

Insights from Ellen Hall the head of direct real estate at Fidelity Investments on core strategies, diversification, and identifying value in today's commercial real estate market.

Advisor Perspectives

DECEMBER 5, 2023

Unlike with a 401(k) plan, you can withdraw as much as you want from your 529 plan at any time. But your 529 plan withdrawal could hit you with severe tax penalties if you use it on nonqualified expenses.

Wealth Management

DECEMBER 5, 2023

Therese Icuss, managing director, portfolio management and underwriting, Fidelity Investments, unlocks the vast potential of the U.S. and China middle market, Fidelity's unique approach to bespoke portfolios, and prioritizing client success in the fidelity private credit fund.

Speaker: Cheryl J. Muldrew-McMurtry

Remote finance teams are rewriting how the back-office runs—and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats have become more than just “growing pains”. They’re now liabilities. The challenge isn’t just team distribution, but building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Advisor Perspectives

DECEMBER 5, 2023

Trench warfare in the early 20th century has been described as long periods of boredom punctuated by moments of terror.

Wealth Management

DECEMBER 5, 2023

As usual, the challenge is communication.

Million Dollar Round Table (MDRT)

DECEMBER 5, 2023

By Mark D. Olson, CFP, MSFS Belonging to a book club, especially an MDRT book club, is an investment in yourself. It’s a fantastic way to meet other MDRT members as you discuss your biggest takeaways from business books that can change the way you approach your life professionally — and sometimes personally. Here are a few of the books read by MDRT book clubs: “Smarter Faster Better: The Transformative Power of Real Productivity” by Charles Duhigg Drawing on the latest findings in neuroscience,

Wealth Management

DECEMBER 5, 2023

David Gaito, head of direct lending at Fidelity, explores the world of direct lending, middle market credit, and the potential of private credit in portfolio diversification and risk management.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Trade Brains

DECEMBER 5, 2023

Top 7 Derivatives Trading Courses in 2024 : Derivatives are secondary markets where the performance of an instrument is dependent on an underlying asset or a group of assets. As you know, derivatives are advanced trading/investment instruments and they require skill and knowledge to trade in them. Hence, these courses will guide you to learn the role of futures and options in portfolio construction and spotting trading opportunities.

Wealth Management

DECEMBER 5, 2023

Mike Bailey, consultant at Fidelity Technologies Corporation, shares insights into private equity's superior performance, market differentiation, and diversification benefits.

Clever Girl Finance

DECEMBER 5, 2023

Do you ever feel like your life isn’t quite as put together as you thought it would be? Don’t worry; you aren’t alone. And while there’s some comfort to be had in knowing that you aren’t behind your peers in getting your life together, it can still feel disheartening. Well, it’s not too late to achieve that vision you had in mind! Table of contents Getting your life together in 18 steps Expert tip: Take it one step at a time What does it mean to get your life together?

MainStreet Financial Planning

DECEMBER 5, 2023

There is so much talk these days about behavior change. It applies to almost everything we encounter in life. If we want to eat healthy, exercise more regularly, be more productive at work, have better relationships or even be better with our finances, we need to work on changing our behavior to make a difference. As the new year is quickly approaching, now is a great time to get energized about change.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Let's personalize your content