Personal Income increased 0.6% in October; Spending increased 0.4%

Calculated Risk

NOVEMBER 27, 2024

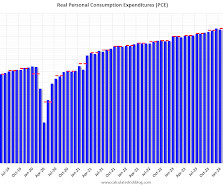

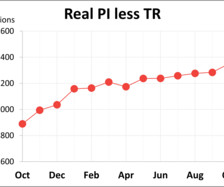

The BEA released the Personal Income and Outlays, October 2024 report for October: Personal income increased $147.4 billion (0.6 percent at a monthly rate) in October , according to estimates released today by the U.S. Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $144.1 billion (0.7 percent) and personal consumption expenditures (PCE) increased $72.3 billion (0.4 percent).

Let's personalize your content