Part 1: Current State of the Housing Market; Overview for mid-January 2025

Calculated Risk

JANUARY 14, 2025

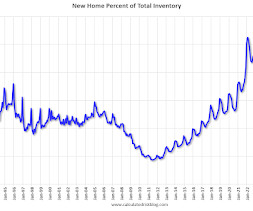

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-January 2025 A brief excerpt: This 2-part overview for mid-January provides a snapshot of the current housing market. I always focus first on inventory, since inventory usually tells the tale ! Im watching months-of-supply closely. New home inventory, as a percentage of total inventory, is still very high.

Let's personalize your content