Our Dotcom Bubble

The Irrelevant Investor

MAY 10, 2022

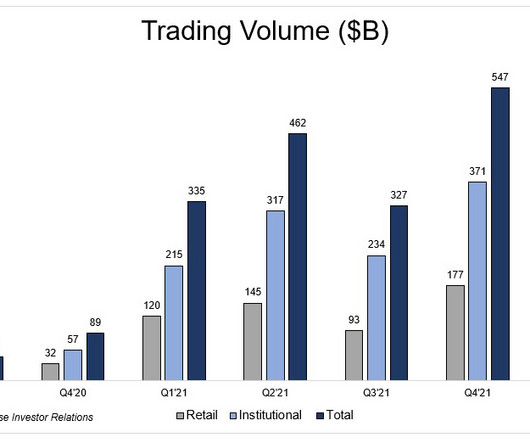

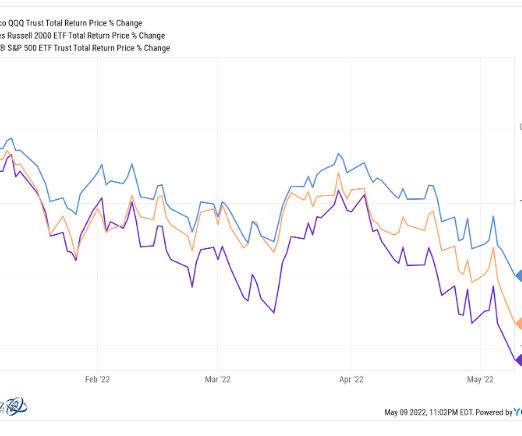

Add Coinbase to the pile of stocks that were down 80% from their highs going into earnings that falls 15% after the announcement. The stock is at $61 in the after hours. It was $130 last Wednesday. I was 15 years old when the dot-com bubble burst, so I didn't get to experience that through the lens of an investor. This is a first for me, and for many of you.

Let's personalize your content