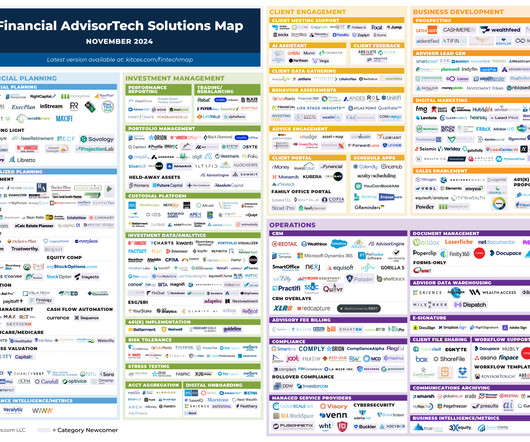

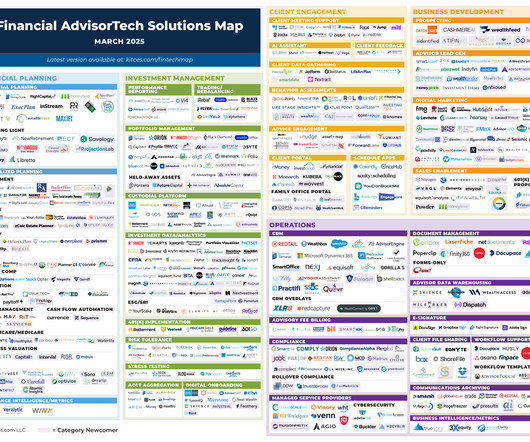

Holistiplan Launches Estate Plan Document Extraction Tool (And More Of The Latest In Financial #AdvisorTech – November 2024)

Nerd's Eye View

NOVEMBER 4, 2024

This month's edition kicks off with the news that Holistiplan has announced the rollout of a new estate plan document extraction tool to stand alongside its highly popular tax return scanning tool – which highlights how advances in AI technology have allowed tools like Holistiplan to go beyond tax returns and scan nearly any kind of document (..)

Let's personalize your content