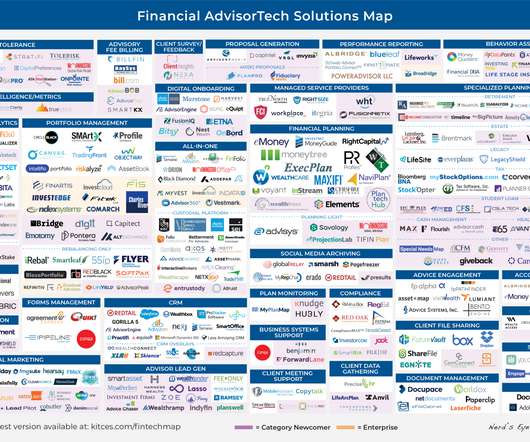

The Latest In Financial #AdvisorTech (June 2023)

Nerd's Eye View

JUNE 5, 2023

This month's edition kicks off with the news that Riskalyze has completed its previously-announced rebranding, and will now be known as “Nitrogen”, a ”growth platform” for advisory firms – which represents less of a shift in the platform’s core function (given that Riskalyze’s risk tolerance tool was always (..)

Let's personalize your content