11 Reasons Why People Hire Advisors (And How To Communicate That Value To Prospects)

Nerd's Eye View

JUNE 23, 2025

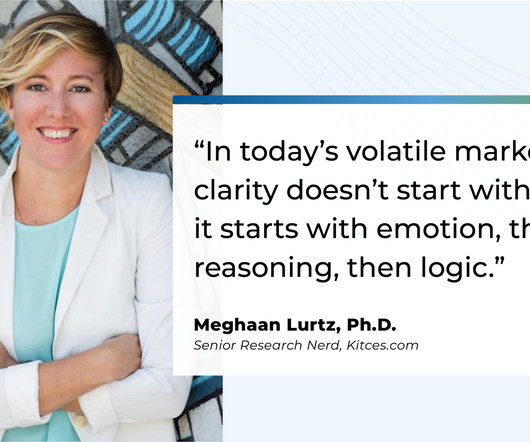

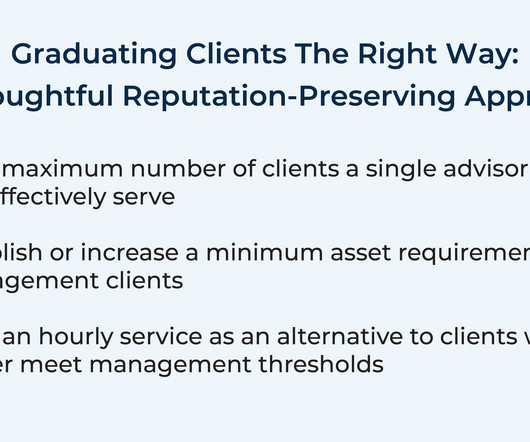

Advisors have a relatively brief window of time to communicate their value to prospective clients. This means advisors must communicate both their services and values within a very limited – and not always synchronous – span of time. Ultimately, refining an advisor's messaging is an ongoing and iterative process.

Let's personalize your content