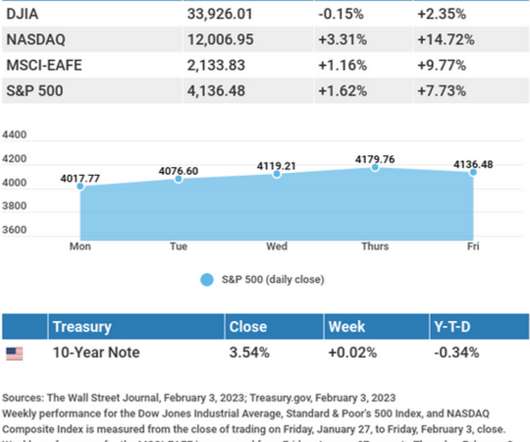

Weekly Market Insights – February 6, 2023

Cornerstone Financial Advisory

FEBRUARY 6, 2023

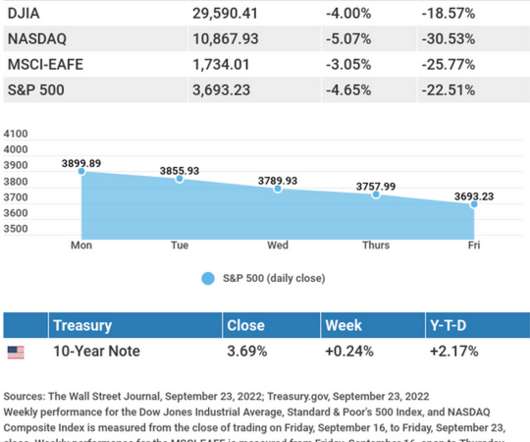

Another Rate Hike The Federal Reserve raised interest rates by 0.25%, signaling to the financial markets that it would likely hike rates by another 25 basis points at its next meeting in late March. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc.,

Let's personalize your content