Build (Customized) Flexible Estate Planning Strategies In A Constantly Changing Political Landscape

Nerd's Eye View

APRIL 5, 2023

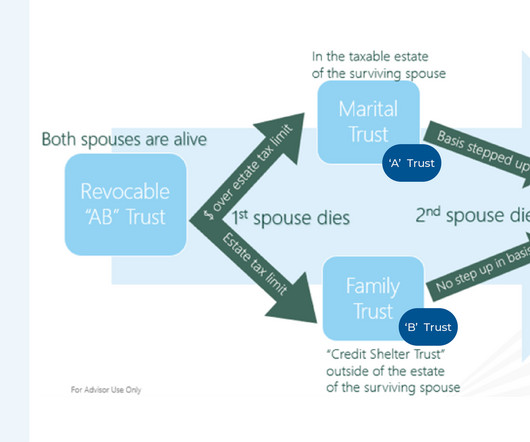

In recent years, the Internal Revenue Code (IRC) has endured some drastic changes resulting from legislative action that have altered the strategies estate planning professionals have recommended to clients. However, the passage of TCJA resulted in the estate gift tax exemption nearly doubling (from $5.6M

Let's personalize your content