Looking for a conversation starter with your clients? Happy National Financial Awareness Day!

Nationwide Financial

AUGUST 14, 2022

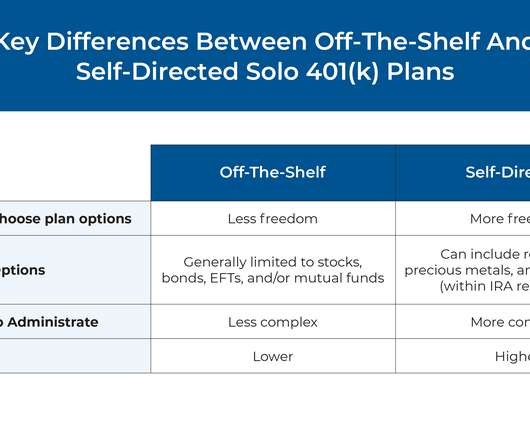

National Financial Awareness Day is a great time for clients to reflect on their financial practices and plan for a more secure future. Setting goals, making small changes, and talking to you, their trusted advisor, can help clients build confidence in their own financial literacy. Retirement Planning.

Let's personalize your content