Establishing Solo 401(k) Plans For Self-Employed Workers: Options, Contribution Limits, Deadlines, And More!

Nerd's Eye View

NOVEMBER 23, 2022

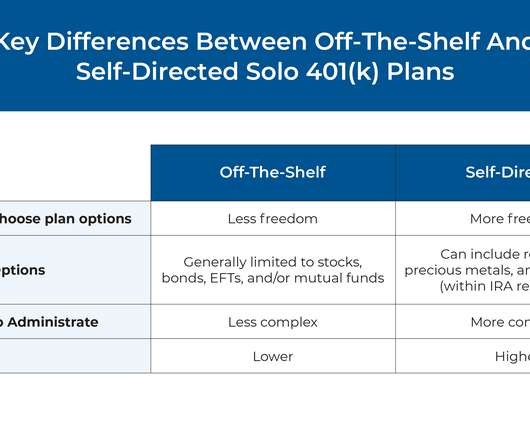

Among the several different types of retirement plans that are available to self-employed workers, solo 401(k) plans can offer the most flexibility and the ability to contribute the highest amount of tax-advantaged savings.

Let's personalize your content