FPA Unveils Cybersecurity Certification Program

Wealth Management

APRIL 2, 2025

The organization has completely rebuilt its cybersecurity certification program, originally introduced in 2020, given regulatory changes in the past five years.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

APRIL 2, 2025

The organization has completely rebuilt its cybersecurity certification program, originally introduced in 2020, given regulatory changes in the past five years.

Wealth Management

MAY 1, 2024

Certified advisors differentiate themselves by being equipped to offer comprehensive services that address complex client needs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

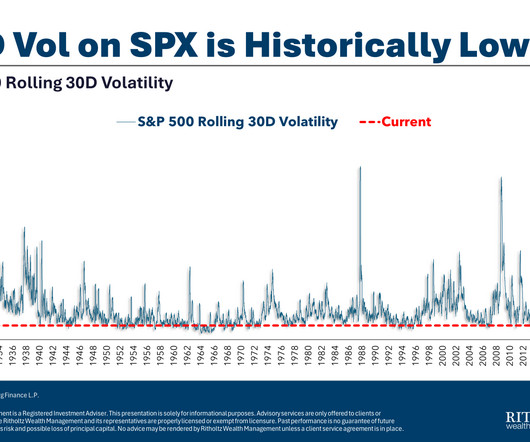

OCTOBER 21, 2024

Key considerations for investors.

Abnormal Returns

JULY 7, 2025

financialplanningassociation.org) How much do clients care about certifications? (wealthmanagement.com) Advisers How to create the ideal environment for a client meeting. meghaanlurtz.substack.com) No matter your prospecting skills, not everyone is a fit. financial-planning.com) Some thoughts one year after selling a practice.

Nerd's Eye View

NOVEMBER 1, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that SIFMA, which represents broker-dealers, investment banks, and asset managers, released a white paper that argues that CFP Board "increasingly functions as a de facto private regulator for CFP certificants" and proposes that CFP (..)

Nerd's Eye View

MAY 19, 2025

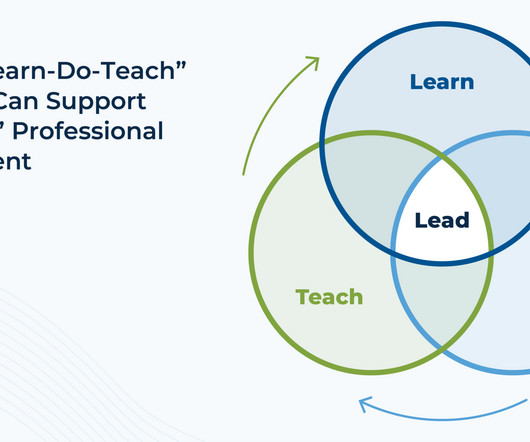

Even for advisors with a CFP certification or other credentials, honing these skills and the confidence to use them in real-time client interactions requires additional practice. To address this, associate advisors often rely on shadowing lead advisors and other team members, completing supervised work, and participating in debriefs.

Abnormal Returns

FEBRUARY 10, 2025

crr.bc.edu) Advisers Certifications are important, but connecting with clients is paramount. (morningstar.com) Robinhood's ($HOOD) proposed robo-advisor offering seems plain vanilla. riabiz.com) Health The case against HSAs. kitces.com) People seem to underestimate the chances of needing long term care.

Wealth Management

JANUARY 11, 2024

A redesigned CAIA certification program for alternative investments highlights the need for advisors to approach the sector as a long-term, strategic play.

Wealth Management

APRIL 10, 2024

The Investments & Wealth Institute has updated its CIMA certification curriculum and exam for the first time since 2019.

Nerd's Eye View

APRIL 25, 2023

Ari is Managing Partner of Values Added Financial, an independent RIA based in Washington, D.C., that oversees $143 million in assets under management (AUM) for nearly 75 client households. Welcome back to the 330th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Ari Weisbard.

Wealth Management

AUGUST 2, 2022

Empty certifications that require no experience and limited interaction only adds to plan sponsors’ mistrust of the industry.

Nerd's Eye View

MARCH 11, 2025

Lorie is the wealth manager of Fearless Financial Advisors, a dba of hybrid advisory firm Fidelis Wealth Advisors based in Castle Rock, Colorado, where Lorie personally oversees $30 million in assets under management for 88 client households. Welcome to the 428th episode of the Financial Advisor Success Podcast !

Wealth Management

MARCH 1, 2023

Big financial institutions don’t feel the need to offer competitive rates on certificates of deposit, which are universally below the world’s safest asset: Treasury bills.

International College of Financial Planning

JULY 2, 2025

And for those looking to become such professionals, the question naturally arises: Is pursuing the Certified Financial Planner (CFP) certification worth it in India? What is the CFP Certification? The Certified Financial Planner (CFP) certification is widely regarded as the gold standard in personal financial planning.

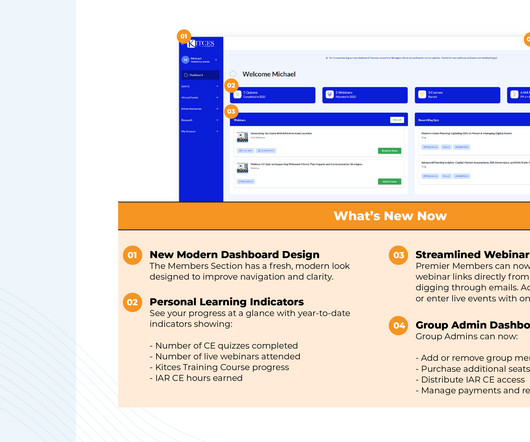

Nerd's Eye View

JUNE 30, 2025

We recently hired several new team members, including Managing Editor Robert Long and Research Associate Karl VonZabern! And yes, our IAR CE Intensives will still cross-apply CE credit for all other eligible CE types, including CFP, CPA, all the designations from IWI, College for Financial Planning, the American College, and more!

Nerd's Eye View

MARCH 25, 2025

AJ is the co-founder of Brooklyn Fi, an RIA based in Brooklyn, New York but operating as a fully remote business, that oversees $370 million in assets under management for more than 400 client households. My guest on today's podcast is AJ Ayers.

Nerd's Eye View

SEPTEMBER 13, 2024

Which means that while many fee-only RIAs use the reduced conflicts that come with the fee-only model (as opposed to firms that receive compensation from commissions and other sources) as a key marketing talking point, the fact remains that being truly 'conflict free' is nearly impossible and such claims (which are hard to substantiate) appear to be (..)

Nerd's Eye View

FEBRUARY 10, 2023

Among others, one notable item that could be reviewed is the current certification requirement that a candidate must have attained at least a bachelor’s degree, which some observers have suggested limits the pool of potential CFP professionals at a time of high demand for advisor talent.

International College of Financial Planning

JUNE 5, 2025

When I first stepped into the world of wealth management, we didn’t have fancy dashboards. This generation of wealth owners isn’t just managing money, they’re about managing meaning. What This Means for Advisors We can’t just be portfolio managers anymore; we need to evolve into kinda life architects. Often fast.

Nerd's Eye View

FEBRUARY 23, 2024

Which suggests that instead of trying to go head-to-head with these larger firms (and their heftier marketing budgets) in attracting clients, smaller firms might instead demonstrate how they are 'different' by offering a unique service offering tailored to their ideal target clients.

Fintoo

JUNE 26, 2025

Once confined to paper certificates, vaults, and real estate deeds, wealth today lives in the cloud, in digital wallets, on investment platforms, and across financial apps. Why cybersecurity is the new cornerstone of wealth protection in 2025 The way we understand, grow, and store wealth has transformed drastically.

Nerd's Eye View

OCTOBER 3, 2023

Brett is the Founder of Brett Danko Educational Center, a CFP Board Education and Exam Prep provider, and the CEO and Managing Partner for Main Street Financial Solutions, an independent RIA based in Newtown, Pennsylvania, that oversees almost $2 billion in assets under management for nearly 1,700 client households.

Nerd's Eye View

OCTOBER 31, 2023

Jon is the Founder and CIO for Echo45 Advisors, an independent RIA based in Walnut Creek, California, that oversees $163 million in assets under management for more than 180 client households. My guest on today's podcast is Jon Henderson.

Nerd's Eye View

MAY 7, 2024

Hannah is a partner and financial advisor at Lomanto Provost Financial Advisors, a hybrid advisory firm based in Plattsburgh, New York, that oversees approximately $150 million in assets under management for about 380 client households.

The Big Picture

AUGUST 1, 2022

I’ve been an Amazon customer since my college roommate gave me a gift certificate in 1998. The reasons for this are simple: If you already have a repair and warranty division to manage ordinary warranties, it costs you next to nothing to repair or replace the stuff off warranty. This leaves lots of room for profit.

International College of Financial Planning

JULY 9, 2025

We have a great deal of participation in high ticket size products like Portfolio Management Services (PMS) & Alternative Investment Funds (AIF). Lakhs Employees of their Wealth Management team. Independent of your employment nature in the Wealth Management space, it does create a tremendous differentiation to be CFP certified.

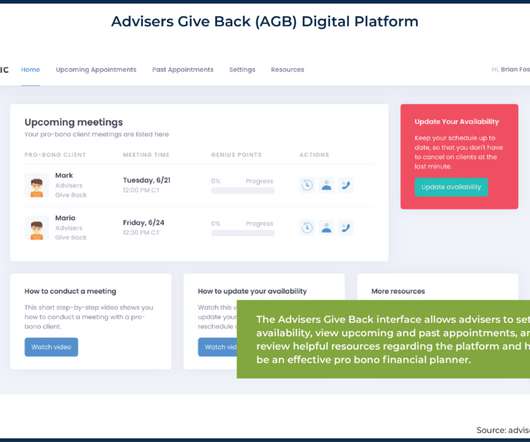

Nerd's Eye View

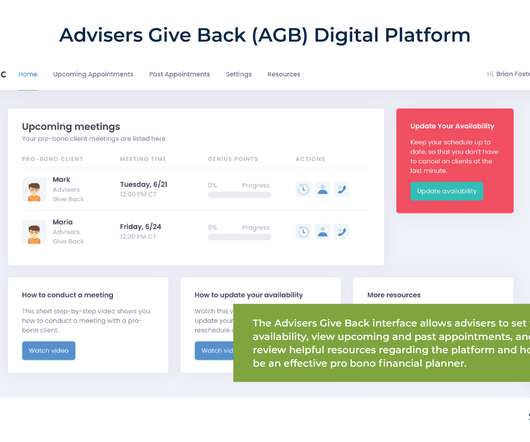

AUGUST 15, 2022

Most advisors are already familiar with many of the issues these individuals face, from setting goals to debt management, although the specifics might be slightly different given the typically lower incomes and wealth of pro bono clients. law) with established pro bono programs.

International College of Financial Planning

FEBRUARY 23, 2024

At the heart of this profession lies the financial planner certification, a credential that not only signifies expertise but also opens doors to significant career opportunities. This certification is recognized globally and is considered a benchmark for competence and professionalism in financial planning.

Nerd's Eye View

MAY 22, 2023

And there are even advantages for the firm’s existing employees who mentor the interns: the opportunity to train, teach, and manage interns can provide valuable leadership experience to benefit their own career development.

A Wealth of Common Sense

JULY 12, 2024

Messengers with huge black boxes on wheels, filled with stock and bond certificates, scurried from broker to broker tr. One of my favorite parts of the book is where Ellis looks at how Wall Street has changed in the past 50 years: MBAs were uncommon. PhDs were never seen. Commissions still averaged 40 cents a share.

Nerd's Eye View

AUGUST 15, 2022

Most advisors are already familiar with many of the issues these individuals face, from setting goals to debt management, although the specifics might be slightly different given the typically lower incomes and wealth of pro bono clients. law) with established pro bono programs.

International College of Financial Planning

APRIL 25, 2024

This certification is recognized globally and showcases a deep, systematic understanding of personal financial management, including investment planning, risk management, tax planning, and retirement planning. Individuals who earn this certification are thoroughly prepared to offer expert financial advice.

Nerd's Eye View

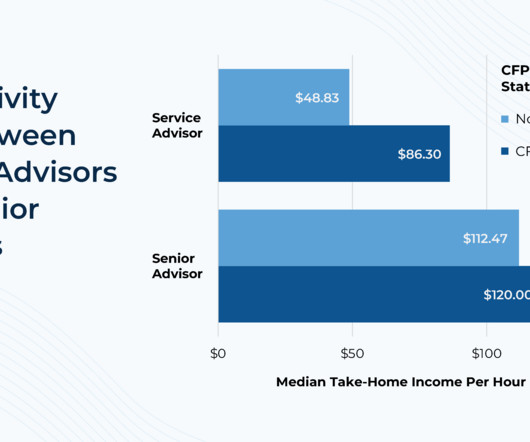

SEPTEMBER 9, 2024

The typical service advisor without CFP certification earns $48.83 The knowledge obtained through CFP certification can forge a more planning-centric practice, offering financial plans that are more comprehensive and updated more frequently – which are clear value-adds for high-net-worth households who often have complex planning needs.

International College of Financial Planning

OCTOBER 26, 2023

Their primary objective is to ensure that the assets are managed & distributed according to the wishes of the client. Estate planning is a significant aspect of financial management that ensures the seamless transfer of assets to the next generation and the fulfilment of an individual’s wishes after their demise.

Tobias Financial

AUGUST 28, 2023

In the midst of interest rate hikes, the world of certificates of deposit (CDs) is buzzing. Learn more here: [link] The post Navigating High-Yield Certificates of Deposit in a Changing Interest Rate Landscape appeared first on www.tobiasfinancial.com.

Nerd's Eye View

JULY 17, 2023

In the 2nd half of the year and into 2024, we'll also be hiring a new Manager of People & Culture, a Curriculum DesigNerd and Instruction DesigNerd for our Education team, and a full-time Director of Advisor Research.

Nationwide Financial

DECEMBER 1, 2022

When clients avoid investing and instead hold a large portion of assets in cash or other low-risk investments (such as money markets, certificates of deposit and bonds) during periods of high inflation, it could ultimately work against their long-term goals. 4 And the nearly $4.46 trillion 5 currently parked in U.S. Cash on the sidelines.

International College of Financial Planning

OCTOBER 26, 2023

If the thought of enlightening others on sound financial choices resonates with you, if you’re intrigued by the world of investment management, and if building lasting relationships is your forte, then financial advisor as a career choice is the chosen one. Various profiles as a Financial Advisor?

Yardley Wealth Management

DECEMBER 17, 2024

The post Set Your Financial Goals for 2025: A Strategic Approach to Building Your Wealth appeared first on Yardley Wealth Management, LLC. Garry Esquire, CFP®, MBA Founder & CEO of Yardley Wealth Management Setting meaningful financial goals in 2025 requires more than just wishful thinking – it demands a strategic, well-planned approach.

Trade Brains

JUNE 14, 2025

Indian Energy Exchange Limited (IEX) was established in 2007 and is India’s leading power exchange, providing an automated, nationwide trading platform for the physical delivery of electricity, renewable energy, and certificates, including cross-border electricity trade. are their own, and not that of the website or its management.

Darrow Wealth Management

FEBRUARY 13, 2025

If youre looking for a fee-only financial advisor or wealth manager, its probably because you know fee-only advisors don’t sell products. Although some firms use these compensation methods, the majority base fees on a percentage of assets under management (AUM) for their services. Independent firm.

Trade Brains

DECEMBER 5, 2023

It covers the basics of options, option Greeks, technical analysis, option chain, selecting strike prices, trading strategies, Psychology and money management in options trading. By enrolling in this course, you will learn the options trading concept with risk management techniques. You can enroll in the course here.

Clever Girl Finance

AUGUST 10, 2023

Educational requirements: High school diploma or your GED and a patient care technician certificate. Educational requirements: High school diploma or get a GED, and, typically, a certificate program or get an associate’s degree. You might also be required to conduct healths coaching sessions and pass a certification exam.

Trade Brains

JUNE 13, 2025

Liquid funds are short-term debt mutual funds that allocate investments to instruments such as treasury bills, commercial papers, and certificates of deposit, all having a maturity period of up to 91 days. Expense Ratio: ~0.10% Good fund management, clear disclosure, and consistently good returns make it a balanced option.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content