Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Abnormal Returns

JANUARY 15, 2025

podcasts.apple.com) Retirement Retirement is a great time to do some creative tax planning. theatlantic.com) Five insights from Dana Miranada's new book, "You Dont Need a Budget: Stop Worrying about Debt, Spend without Shame, and Manage Money with Ease." nextbigideaclub.com) Five types of wealth you should actually shoot for.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

OCTOBER 28, 2024

So I hope you'll find this year's 2025 top conferences list (and our updated Master Conference List) to be helpful as a guide in planning your own conference budget and schedule for next year, and be certain to take advantage of the special discount codes that several conferences have offered to all of you as Nerd's Eye View readers!

Nerd's Eye View

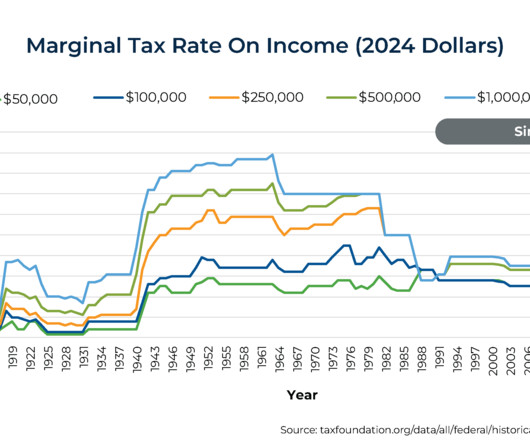

SEPTEMBER 25, 2024

tax policy are predicting that Congress will inevitably be forced to again increase tax rates in order to raise revenue and balance the national budget – and that the current regime of relatively low tax rates will prove to be a temporary phenomenon.

eMoney Advisor

DECEMBER 13, 2022

Yet many still have complex needs requiring more sophisticated and personalized investment, estate, and tax planning services. million households in three key groups who want customized, actionable advice on budgeting, saving, investing, insurance, and planning to help provide peace of mind regarding their finances.

Carson Wealth

JULY 3, 2024

Have a Comprehensive Budget (and Stick to It) A well-structured budget is a roadmap for your business’s financial health. It helps you plan for future expenses, allocate resources efficiently and stay on track with your financial goals. Regularly review your budget to ensure adherence and adjust as necessary.

WiserAdvisor

OCTOBER 4, 2022

Retirement planning can be a bit complex. There are multiple factors to weigh in, right from healthcare and inflation to estate planning, business succession planning, tax planning, and more. However, the main drawback to this can be the lack of foresight regarding what and how to plan. To conclude.

Tobias Financial

JUNE 16, 2025

These events may affect your investment approach, tax planning strategies, insurance needs, and estate planning documents. Without periodic evaluations, it’s possible for parts of your plan to become misaligned with your current circumstances.

Harness Wealth

FEBRUARY 27, 2023

Traditional IPO: Valuation, Lockup Period, and Employee Equity Founders have more options for reducing the tax consequences of an acquisition Founders are generally in the best position to engage in tax planning and limit the taxable consequences associated with an acquisition.

Carson Wealth

JUNE 27, 2025

In addition to common types of insurance such as auto, property, and life insurance, you might consider kidnap and ransom insurance, insurance for luxury items, customized liability coverage that can extend coverage limits for other policies, business and succession planning insurance, etc. Tax planning. Budget for emergencies.

Inside Information

JANUARY 31, 2025

Ayasha Jones, partner and Director of Operations at BlueSky Wealth Advisors in New Bern, NC said that she and other ops professionals are inundated with new fintech options all the time, and the IT percentage of the operating budget is larger than it ever was.

Truemind Capital

SEPTEMBER 23, 2024

Creating a Budget That Works for You If you’ve tried budgeting but found it too complicated or hard to stick with, a financial coach can help simplify the process. They’ll create a personalized budget that fits your lifestyle and goals.

Clever Girl Finance

MARCH 19, 2024

Create a list of things to plan for How to make a financial plan Expert tip: Consider your needs for each life stage Determine the type of financial plan you need Tips on how to frequently review your financial plan What is a financial plan using an example? Is a financial plan the same as a budget?

James Hendries

JANUARY 8, 2023

Depending on your situation, this may involve attending financial seminars, using budgeting apps, or working with a financial professional. The information provided is not intended to be a substitute for specific individualized tax planning or legal advice. We suggest that you consult with a qualified tax or legal advisor.

FMG

MAY 19, 2025

Add keywords your audience might use, like Financial Advisor | Retirement Planning or “Wealth Management | Tax Planning.” I help teachers plan their future Book a call Gen Z Money Coach Helping students crush debt & grow wealth. Free budget guide below! Examples of Winning Bios Retirement Ready?

Zoe Financial

MAY 18, 2023

They can help you budget effectively, set up college savings accounts, and explore investment options to support your family’s future financial needs. Some questions that an advisor can help you answer are: How will the budget be handled? When and how do I start planning & savings for my kids’ college?

MazumaBusinessAccounting

JULY 15, 2021

Strategizing around how to pay yourself, your taxes, and other expenses. While there is a lot we could cover on the topic of business planning, for today we are going to focus on 3 important financial elements. Tax Planning. Calculating tax rates can be tricky for small business owners. Succession Planning.

WiserAdvisor

AUGUST 31, 2023

A financial advisor can help with maximizing your retirement income through tax planning After retirement, your income sources may become limited to pensions, Social Security benefits, and investment income. A financial advisor can craft tax-efficient withdrawal strategies to minimize the tax burden on your retirement income.

WiserAdvisor

JUNE 27, 2025

Unless you’ve planned a dedicated healthcare bridge (or have access to employer-sponsored retiree coverage), this cost can derail even the most detailed budget. Why it works: You control your tax rate now instead of leaving it to later. After five years, converted funds can be withdrawn tax- and penalty-free.

Tobias Financial

OCTOBER 13, 2022

Another financial pain point that significantly impacts our budget is taxes. Whether you typically get a refund or owe a tax bill, there are several moves to consider to increase your chances of tax savings. . We often feel helpless when watching interest rates climbing or stocks falling.

Your Richest Life

MAY 29, 2025

Be Honest about what You Need If you find that you are spending too much, are struggling to keep a budget or just cant stay on track with your goals, its a smart idea to enlist some additional help. This is also an ideal time to get some of your tax planning taken care of.

Harness Wealth

NOVEMBER 27, 2023

The Role of Technology in CAS Benefits and Drawbacks of CAS How Harness Wealth Fits into CAS Key Takeaways Client Accounting Services (CAS) provide enhanced budgeting, forecasting, and financial insights to help facilitate informed decision-making.

International College of Financial Planning

SEPTEMBER 7, 2024

At its core, the CFP® Fast Track equips you with the expertise to offer sound financial advice, specializing in areas such as retirement planning, risk management, tax planning, and wealth management. By pursuing this course, you become proficient in helping individuals and companies achieve their financial goals.

eMoney Advisor

FEBRUARY 9, 2023

Their key financial challenges include paying off student loans, creating a budget, developing healthy spending habits, and saving for future goals like buying a home. People in this stage may have just graduated from college and recently joined the working world.

WiserAdvisor

AUGUST 3, 2023

A reputable financial advisor should provide a comprehensive range of services, including budgeting, debt management, insurance optimization, tax planning, retirement planning, estate planning, and investment management. How do you know you are being overcharged by your advisor?

Harness Wealth

MARCH 27, 2025

Cash flow implications PTET’s requirement for upfront tax payments can also impact a small business’s cash flow, particularly those with limited financial reserves. These payments, which can often be substantial, require careful financial planning and proactive cash flow management.

Fortune Financial

SEPTEMBER 25, 2023

Certified Public Accountant (CPA) CPAs specialize in tax planning and accounting. While they may not be exclusively wealth managers, their expertise in tax matters can be invaluable in managing your taxes efficiently. It may encompass budgeting, debt management and developing strategies for saving and investing.

WiserAdvisor

JULY 1, 2022

A sound financial plan for a business can help entrepreneurs establish clear company goals and work towards achieving them. A business financial plan also helps entrepreneurs manage their company’s finances, allocate budget smartly, and engage in fundraising when necessary. Make the best use of tax-saving strategies.

Midstream Marketing

DECEMBER 6, 2024

Running focused social media campaigns that highlight their services and share their skills in areas like tax planning or retirement planning. Email marketing software : Pick an email marketing service that works for you and fits your budget.

International College of Financial Planning

NOVEMBER 10, 2021

In this course program, you’d be trained in concepts such as capital budgeting, risk management, and option valuation to name a few. You’d perhaps need to undergo special certifications as you enter the industry but MBA (Finance) remains a good starting point. As the saying goes CFPs don’t have to hunt for jobs as jobs hunt for them.

Gen Y Planning

DECEMBER 5, 2022

De-clutter Your Budget (Aka Spending Plan). The holiday season often marks increased spending, so it’s a good time to haul out your family budget. . Instead, start thinking of your budget as a spending plan. Your spending plan is a guide to help you use your money in ways that mean the most to you.

eMoney Advisor

FEBRUARY 16, 2023

If the services you currently provide focus on investment management and basic financial planning, advice related to estate planning and settlement, wealth transfer, and tax planning are good value-added services to investigate. Your planning expertise can show them how those decisions will impact their plan.

Workable Wealth

OCTOBER 14, 2020

Overpaying on taxes. Tax Planning. A proactive tax plan can save you thousands of dollars every year. You can accomplish this task in several ways like strategic charitable giving, maxing out your retirement accounts, tax-loss harvesting, and more. Making emotional financial decisions.

WiserAdvisor

SEPTEMBER 8, 2023

It is important to have a clear understanding of your budget post-retirement, factoring in housing costs, property taxes, and maintenance expenses. Rushing into a housing change without a comprehensive budget can strain your finances. Engaging in careful tax planning is essential to navigate this potential tax challenge.

Fortune Financial

SEPTEMBER 25, 2023

Certified Public Accountant (CPA) CPAs specialize in tax planning and accounting. While they may not be exclusively wealth managers, their expertise in tax matters can be invaluable in managing your taxes efficiently. It may encompass budgeting, debt management and developing strategies for saving and investing.

WiserAdvisor

JULY 3, 2023

Creating a budget can help physicians overcome these issues. A budget can offer you a clear understanding of your income, expenses, and spending habits. A budget is like a snapshot of your financial health. Many physicians do not have a budget to help them plan their finances for every month.

International College of Financial Planning

MARCH 31, 2023

The program comprises of six modules that cover a range of topics related to wealth management: Module 1: Introduction to Wealth Management Introduction to Wealth Management Wealth Management Process Wealth Management Strategies Module 2: Financial Planning & Analysis Introduction to Financial Planning Analysis of Financial Statements (..)

WiserAdvisor

APRIL 16, 2025

Make sure to look into their expertise before hiring and select an advisor who aligns with your financial needs, personality, and budget. You need objective financial advice that is not impacted by emotions One of the most common challenges in investing or any form of financial planning is managing the emotional aspect.

Indigo Marketing Agency

JUNE 20, 2023

For instance, an uptick in searches related to tax planning in the beginning of the year could see your ads performing very well, until the April 15th tax deadline, when the frenzy for tax advice decreases substantially. Tired of wasting your marketing budget on ads that go nowhere?

Harness Wealth

MAY 25, 2023

The ranges provided are related to the cost charged by the Financial Adviser and do not incorporate additional expenses associated with implementing a financial plan, such as custodial or transaction costs. Ask About Experience : Experience in financial planning and specific areas of expertise that align with your needs are vital.

Inside Information

JULY 28, 2023

Of course, the people asking these questions have never actually worked with a client, and they don’t really understand the ripple effects of their budget cuts. If these client advocates persist in objecting as more budget cuts are enacted (and they usually will), then they will be encouraged to leave because they are ‘not team players.’

WiserAdvisor

JUNE 2, 2023

Wealth managers Wealth managers primarily work with wealthy investors and hold expertise in several fields, such as investment planning, estate planning, tax planning, insurance planning, charitable donations, etc. They help prepare a retirement plan based on a client’s financial needs and goals.

WiserAdvisor

FEBRUARY 29, 2024

They help you optimize tax planning Tax planning is an important aspect of financial planning that can significantly impact your long-term wealth accumulation. It helps you strategically minimize the amount you pay in taxes and maximize your investment returns to preserve more of your hard-earned money.

WiserAdvisor

AUGUST 8, 2022

Getting the right financial advisor: Financial planning for high-net-worth individuals can include tax planning, managing philanthropic activities like charity, asset protection, estate and succession planning, and risk management, among several other things. As a result, the risk involved is relatively higher.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content