How to Determine Your Client’s Risk Tolerance

BlueMind

SEPTEMBER 3, 2022

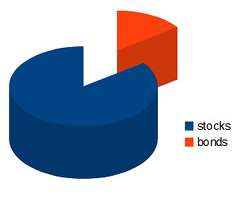

Category: Clients Risk. Determining the client’s risk tolerance is not an exact science and requires you to communicate with your client. What Does The Word “Risk” Mean For Your Clients? For some clients, “risk” maybe something exciting or daring that they enjoy and not something they generally avert from.

Let's personalize your content