Financial Market Round-Up – Apr’24

Truemind Capital

APRIL 19, 2024

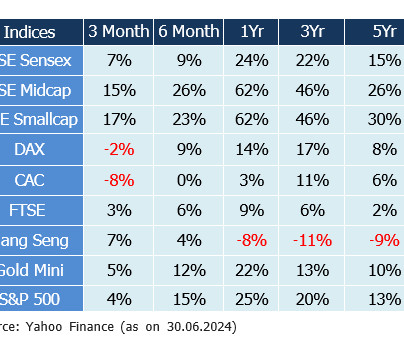

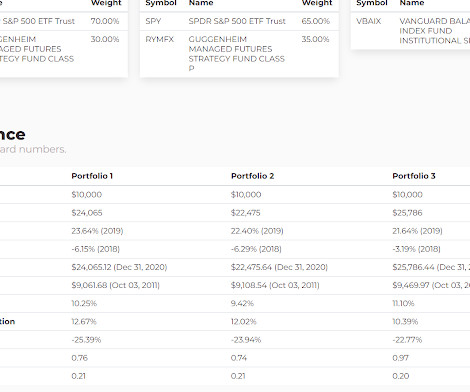

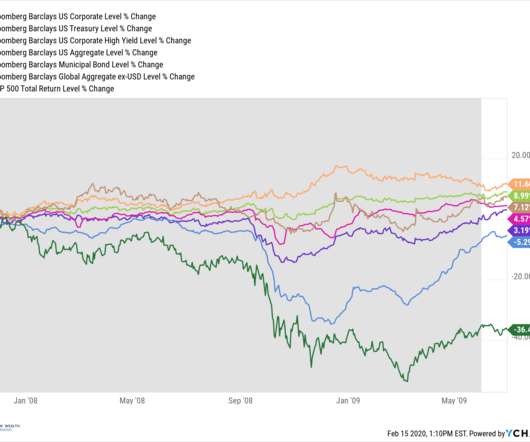

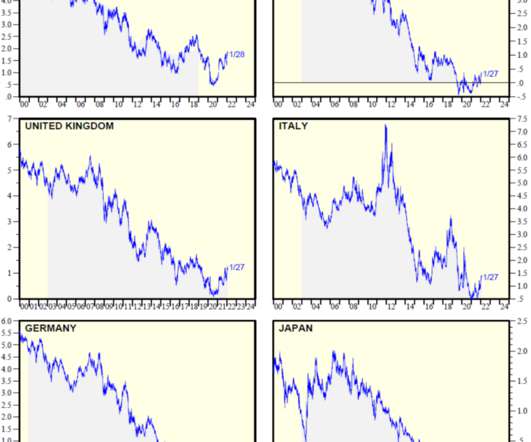

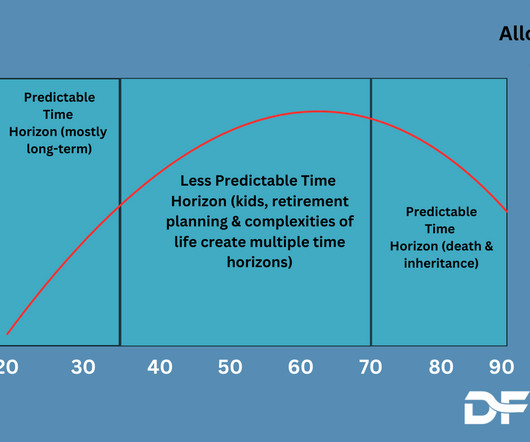

Consequently, the portfolio allocation should reflect these probabilities depending on the risk profiles. Therefore, we maintain our underweight position to equity (check the Model Portfolio Current asset allocation below). One can consider debt portfolios with floating rate instruments for long-term allocation.

Let's personalize your content