Comfortable Retirement for Clients in Sight? Think Again

Wealth Management

MAY 19, 2023

Education on key asset allocation strategies is necessary to get clients ready for their golden years.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MAY 19, 2023

Education on key asset allocation strategies is necessary to get clients ready for their golden years.

Validea

OCTOBER 28, 2024

We explore several clips from our interviews where Meb shares perspectives that often challenge conventional wisdom, including his thoughts on dividend investing, trend following, and the Federal Reserve.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Brown Advisory

SEPTEMBER 6, 2022

Asset Allocation: Developing a Long-Term Investment Strategy for Mission-Driven Organizations. When putting a plan in place, we believe it is critical for any mission-driven organization to develop an effective, long-term asset allocation strategy to manage its endowment assets. Tue, 09/06/2022 - 10:30.

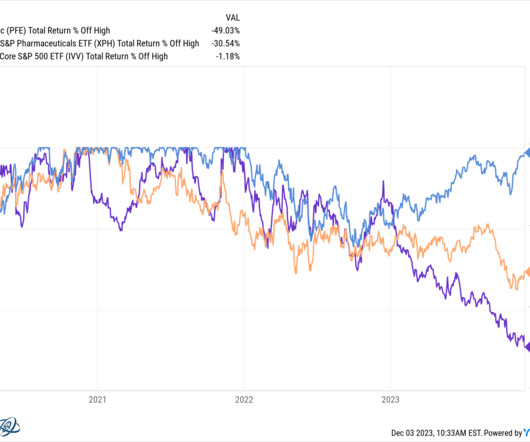

Abnormal Returns

DECEMBER 3, 2023

awealthofcommonsense.com) There are a lot of different asset allocations you can live with. downtownjoshbrown.com) College-educated women with children under 10 are in the workforce at record numbers. (wsj.com) Strategy Remember all that talk about how the 60/40 portfolio was broken? axios.com) Q4 GDP is tracking around 1%.

The Chicago Financial Planner

FEBRUARY 3, 2022

Investors who are well-diversified may be hurt but generally not to the extent of those who are highly allocated to stocks. Review your asset allocation . If you haven’t done so recently, perhaps it is time to review your asset allocation and make some adjustments. Go shopping . FINANCIAL WRITING.

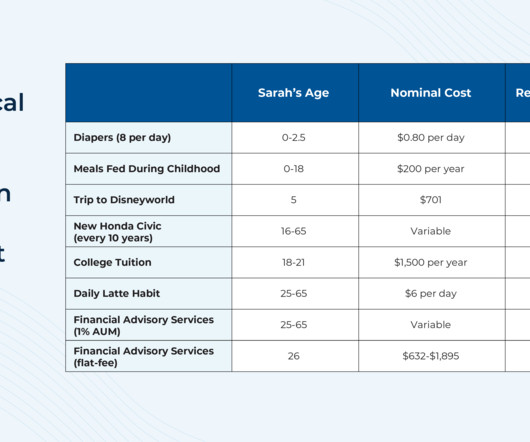

Nerd's Eye View

OCTOBER 23, 2024

While the financial advice industry has transformed in many ways over the past several decades, one aspect that has remained relatively constant is the use of the Assets Under Management (AUM) fee model as a common way for many advisors to get paid.

WiserAdvisor

DECEMBER 2, 2022

When investors create an investment portfolio, they consider several factors, like risk, asset class, inflation, etc., However, what is equally critical when it comes to creating a portfolio is asset allocation and selection. If not allocated efficiently, you may become subject to a slew of taxes and other charges.

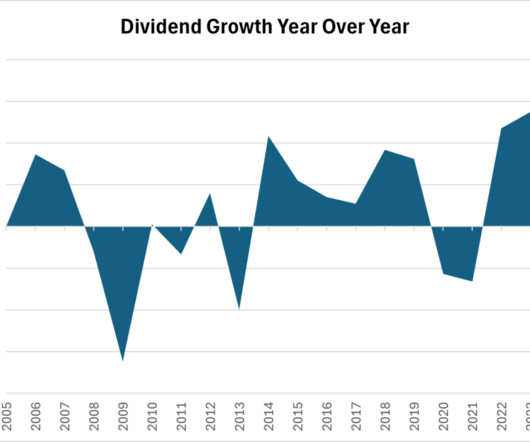

Darrow Wealth Management

FEBRUARY 9, 2025

When investing in dividend stocks, bonds, or funds, a higher dividend yield may make an asset look more attractive, but this metric alone doesn’t make a worthwhile investment. In another words, if your asset allocation is 60% stocks and 40% bonds, the current weighted average yield is 2.19%.

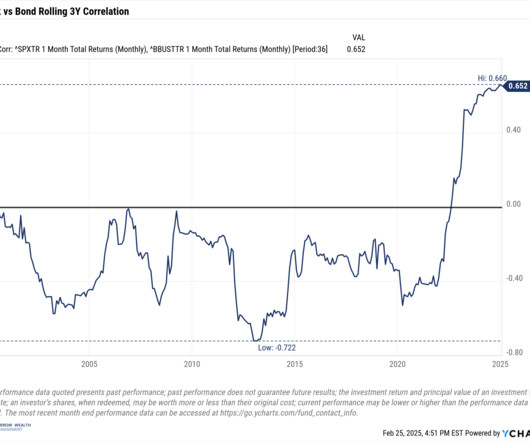

Darrow Wealth Management

MARCH 3, 2025

Because of these differences, stocks and bonds accomplish different things in an asset allocation. But it helps illustrate the importance of diversifying within an asset class like fixed income. Morgan Asset Management. But correlations shift over time and within the asset class itself. Morgan Asset Management.

Alpha Architect

JUNE 17, 2025

Modern Portfolio Theory (MPT) has long served as a foundational framework for asset allocation and portfolio construction. This concept remains influential in both academic finance and practical investment management.

The Chicago Financial Planner

JUNE 13, 2022

Ideally you’ve been rebalancing your portfolio along the way and your asset allocation is largely in line with your plan and your risk tolerance. Financial coaching focuses on providing education and mentoring on the financial transition to retirement. NEW SERVICE – Financial Coaching. FINANCIAL WRITING.

The Big Picture

MAY 7, 2025

His firm, Efficient Frontier Advisors manages $400 million in client assets ($25m minimum). You’re going give up some time, some effort, a lot of education, and potentially a lot of money. He is also the author of multiple books, the Intelligent Asset Allocator, four Pillars of Investing, investors Manifesto, and on and on.

The Big Picture

APRIL 29, 2025

This is Masters in business with Barry Ritholtz on Bloomberg Radio 00:00:17 [Speaker Changed] This week on the podcast, Jeff Becker, chairman and CEO of Jenison Associates, they’re part of the PG Im family of Asset Managements. Jenison manages over $200 billion in assets. Each of these asset managers had A-A-C-E-O.

Darrow Wealth Management

MARCH 13, 2025

If one stock makes up more than 10% of your overall asset allocation, it’s probably too much. Diversifying Around It: Balancing the portfolio by investing in assets that offset the concentrated position’s risk. This includes the stock itself, its sector, industry, and other highly correlated assets.

Carson Wealth

JANUARY 22, 2025

But what does this mean for your portfolio, and how can you continue to protect and grow your assets during these times? Higher numbers indicate more volatility, lower numbers mean less volatility, and a negative beta, which is rare, means an asset is expected to move in the opposite direction of the market. What Is Market Volatility?

The Chicago Financial Planner

FEBRUARY 5, 2022

Perhaps it’s time to rebalance and to rethink your ongoing asset allocation. Financial coaching focuses on providing education and mentoring on the financial transition to retirement. Take stock of where you are. What impact have the solid stock market gains of the past three years had on your portfolio? Costs matter.

Validea

APRIL 17, 2023

Most investors pay close attention to their asset allocation. And that makes sense since research has shown that the asset classes a portfolio is allocated to drive the majority of its return over time. But asset allocation isn’t the whole story.

Yardley Wealth Management

SEPTEMBER 10, 2024

By spreading your investments across various asset classes, sectors, and geographic regions, you can reduce your portfolio’s overall risk. Consider allocating your assets among stocks, bonds, real estate, and alternative investments. Stay Informed and Educated Successful retirement investing requires staying informed.

MainStreet Financial Planning

MARCH 7, 2025

The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management). Unlike AUM advisors, they dont have an incentive to keep assets under management, so their recommendations are truly objective.

Yardley Wealth Management

DECEMBER 17, 2024

Consider reviewing your asset allocation – not just the standard stocks versus bonds split, but also your exposure to different sectors, geographic regions, and alternative investments. Real estate investment opportunities, whether through REITs or direct property ownership, deserve attention in 2025.

International College of Financial Planning

JULY 30, 2022

Certified Financial Planner (CFP) is globally the most respected financial designation for personal assets management. For e.g. saving for a home, retirement, or Higher education. One can do CFP online course for the most comprehensive financial planning services, which often include asset management.

Harness Wealth

NOVEMBER 12, 2024

Consider 529 Plans A 529 Plan is a tax-advantaged investment account specifically designed to fund education costs. This can be a particularly useful method for estate planning and maximizing tax benefits, as the funds grow tax-free when used for qualified education expenses. Find your next tax advisor at Harness today.

Zoe Financial

MARCH 21, 2025

Their role extends beyond investment managementthey can help with: Retirement Planning : Structuring your assets to support your desired lifestyle. Risk Management : Protecting assets from unforeseen events. Provide insights on asset allocation and risk management. Help allocate funds based on long-term financial goals.

The Chicago Financial Planner

NOVEMBER 8, 2021

If so, this is a good time to revisit your asset allocation and perhaps reduce your overall risk. Financial coaching focuses on providing education and mentoring on the financial transition to retirement. Learn from the past . It is said that fear and greed are the two main drivers of the stock market. FINANCIAL WRITING.

Advisor Perspectives

APRIL 29, 2024

But advisors need education on the role alternatives can play in asset allocation and how creating portfolios that complement traditional assets drive business growth. Why access to alternatives is a given, and the focus should be on portfolio construction of alternatives with traditional assets.

SEI

AUGUST 2, 2022

Higher education. Fueled by our joint study with AGB, our recent three roundtable events were well attended and yielded practical insights for financial professionals within higher education. Use of an OCIO was 40%, as this size segment of higher education has been moving more recently into this investment partner model.

Carson Wealth

MARCH 21, 2025

An endowment is a portfolio of assets that is invested to provide support for a cause. Theyre established to benefit charitable organizations, including educational or cultural institutions, community organizations, service organizations such as hospitals, and other nonprofits. What Is an Endowment?

The Richer Geek

OCTOBER 12, 2022

Jeff also leads a private inner circle mastermind that helps educate over 1000 investors on how to navigate the crypto markets. After graduating with a bachelors in finance in 2016, his professional investment career began in asset management for the largest bank in the US, JP Morgan Chase.

James Hendries

MARCH 13, 2023

Instead, we got a shockingly fast collapse of a financial institution with over $200 billion in assets, which turned the market’s focus toward the stability of the banking system and what systemic risks banks might be facing. References to markets, asset classes, and sectors are generally regarding the corresponding market index.

Talon Wealth

OCTOBER 26, 2023

Educate yourself about finances. If you don’t know the basics of investing – like asset allocation, diversification, and compounding – then a quick web search can help. It should consider inflation, current savings, and investments’ expected compound annual growth rate.

Trade Brains

DECEMBER 7, 2023

Personal Finance for Beginners by FinGrad FinGrad Academy is an educational platform that offers various courses on financial products for better investment opportunities. Personal Finance – Mutual Funds course by Zerodha Varsity Zerodha Varsity is an educational platform that offers all financial content in different modules.

Discipline Funds

FEBRUARY 21, 2023

This innovative approach to asset allocation helps improve the probability of meeting your financial goals by helping you better understand your liabilities and the way specific assets align with those liabilities. We then apply the proper assets based on liability needs, not based on asset performance wants.

Truemind Capital

SEPTEMBER 30, 2024

But money is required after 5 years, so exposure to equity asset class was recommended to achieve optimum asset allocation mix. #2 3: Client(s) have goals like retirement & children’s education and the time horizon is more than 8-10 years. 2 : FDs were done at very low rates. E.g. 6-6.5%.

International College of Financial Planning

JULY 31, 2023

Investing is essential to achieving our financial goals, whether saving for retirement, funding our children’s education, or building wealth for the future. They are financial experts with extensive education and training in finance and investments. By diversifying investments advisors can help with asset allocation.

International College of Financial Planning

DECEMBER 29, 2024

In today’s increasingly complex financial landscape, professional financial planning education has become more crucial than ever. Understanding the Value of Financial Planning Education Financial markets are becoming increasingly intricate, requiring professionals to stay ahead through continuous learning and development.

Brown Advisory

JULY 17, 2018

The cost of college is growing at an astronomical rate, and Section 529 plans have long helped individuals and families grow assets earmarked for education in a tax-efficient manner. As of this year, Federal law lets you distribute up to $10,000 each year from your 529 plan to fund primary (K-12) education tuition.

Brown Advisory

JULY 17, 2018

The cost of college is growing at an astronomical rate, and Section 529 plans have long helped individuals and families grow assets earmarked for education in a tax-efficient manner. As of this year, Federal law lets you distribute up to $10,000 each year from your 529 plan to fund primary (K-12) education tuition. 1 [link]. .

eMoney Advisor

MARCH 21, 2023

By using your expertise to communicate, educate, and provide perspective, you’ll likely magnify the loyalty of your clients. Prepare your clients by educating them about market dynamics and how the work you do for them will help position their investments for the long term.

eMoney Advisor

DECEMBER 27, 2022

At this level, the focus shifts to growing assets for long-term success and longevity. Financial freedom advances to long-term care and children’s education, as well as retirement savings and vacations. Accumulating wealth refers to growing investments, paying down debt, and saving for retirement.

The Big Picture

SEPTEMBER 12, 2022

They run over $800 billion in client assets, and Kristen’s group, the North American Group, is responsible for about half of the revenue that that massive organization generates. BITTERLY MICHELL: … across asset classes is the way that I think about it. perspective, how you hold your assets is just as important as what you hold, right?

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Clarifying these distinctions will help you prioritize and allocate resources accordingly.

SEI

AUGUST 2, 2022

That’s why, when facing market volatility, stewards of long-term assets held at all types of nonprofit institutions recognize the importance of a well-thought-out investment process. . Investment education is critical. Equities: equity asset classes were down double digits, regardless of size and geography. . Looking forward.

Workable Wealth

SEPTEMBER 16, 2020

The goal of diversification is for your portfolio assets to balance each other out by maximizing profit and minimizing risk. You can diversify your portfolio across asset classes, within assets, and also geographically (think both domestic and foreign markets). Asset Allocation.

James Hendries

SEPTEMBER 27, 2022

The LPL Research Strategic and Tactical Asset Allocation Committee is increasing its recommended interest rate exposure in its tactical allocation from underweight to neutral. In the form of high-quality bonds, interest rate exposure has been a good diversifier to equity risk. Core vs Core Plus Bond Implementation.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content