Massachusetts ‘Millionaires’ Tax Applies to Sudden Wealth Events

Darrow Wealth Management

NOVEMBER 17, 2022

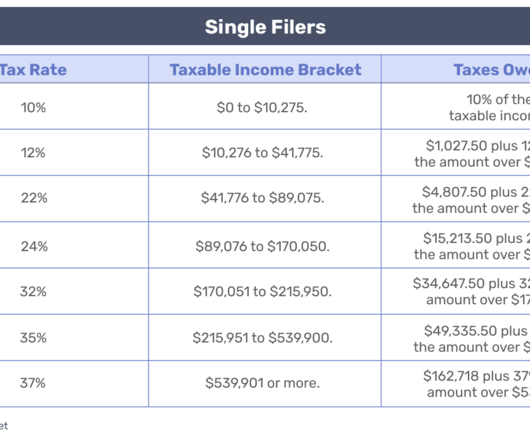

The simple examples above only illustrate the state tax impact, but federal tax implications will also apply. Further, both examples ignore other sources of income, such as wages, pre-tax retirement account distributions, dividends, etc., that could increase the tax due from the surtax.

Let's personalize your content