Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Harness Wealth

JUNE 27, 2025

Finally, the National Taxpayer Advocate warns that despite a smooth 2025 filing season, the 2026 season is at risk due to IRS staffing cuts, with headcount expected to fall from 102,000 to under 76,000. Interested in using Harness at your tax firm, or know a tax firm you’d like to refer to Harness? 30, the report said.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

WiserAdvisor

JULY 4, 2025

The post What are the Tax Brackets and Federal Income Tax Rates for the 2025-2026 Tax Year? Foreign earned income exclusion Working abroad? There is some good news for you, as well! You can exclude up to $130,000 in foreign earned income from your U.S. taxes in 2025. first appeared on WiserAdvisor - Blog.

SEI

JULY 15, 2025

Opportunity zones : Taxes on capital gains can be deferred until December 31, 2026, or until the OZ investment is sold, whichever comes first. Policy proposal landscape 1031 exchange : The Biden administrations 2025 budget proposed a $500,000 cap on deferrable gains, representing a significant potential shift for high-net-worth clients.

Harness Wealth

MARCH 6, 2025

And while pay increases did maintain second place in terms of planned budget boosts for 2025, the volume of those increases is forecast to tumble. As President-elect Donald Trump gets ready for his second term in office, professionals are looking ahead to what the 2026 tax landscape will look like.

Nerd's Eye View

APRIL 30, 2025

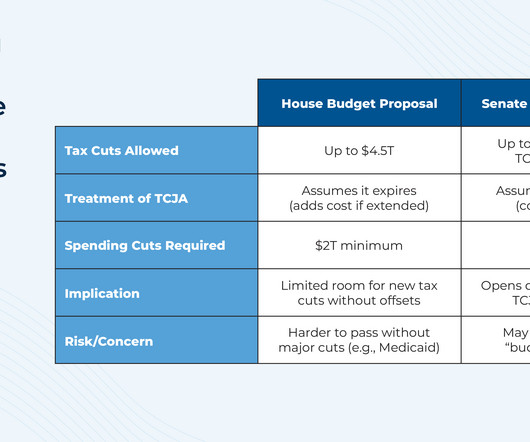

Recently, however, the House and Senate agreed to adopt a budget resolution that represents a crucial first step in the process of passing a 'reconciliation' bill. In the House's version, the budget resolution authorizes $4.5 trillion in tax cuts over the next 10 years, which would mostly cover the estimated $4.6

Carson Wealth

JULY 11, 2025

preventing taxes from going up in 2026, which is by far the most “expensive” part of the bill). Offsetting this are cuts to other parts of the federal budget, mainly Medicaid and safety net programs like SNAP (food stamps). Most of the provisions went toward maintaining the status quo (i.e.,

Let's personalize your content