$2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo

Wealth Management

JULY 18, 2025

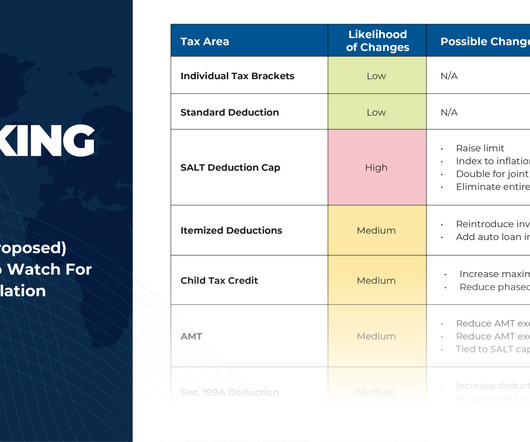

Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B is joining the trend toward combining wealth management and tax planning by merging with Brookfield, Wis. based QBCo Advisory.

Let's personalize your content