The “Art” of Market Timing

The Big Picture

NOVEMBER 27, 2023

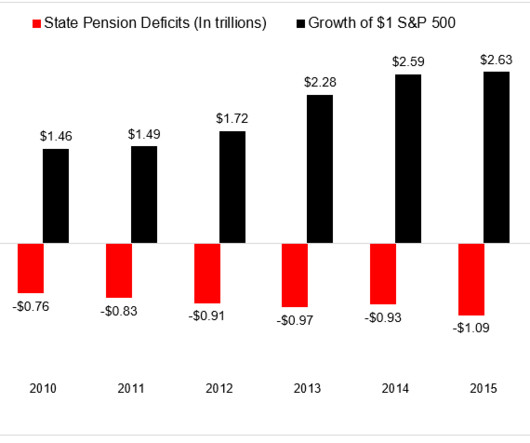

When you get it wrong, it crushes your retirement plans. 24, 2023 _ 1: In particular, why average outperforms over the long run; Sommers credits not making errors (via Charlie Ellis’ “Winning the Loser’s Game”) but the nuance and math are fascinating. The less it matters, the easier it is to be bold and outside of the mainstream.4

Let's personalize your content