Five Things to do During a Stock Market Correction

The Chicago Financial Planner

JUNE 13, 2022

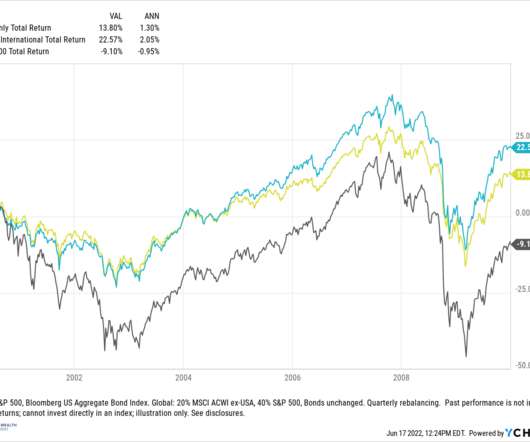

Ideally you’ve been rebalancing your portfolio along the way and your asset allocation is largely in line with your plan and your risk tolerance. For example during the 2008-2009 market debacle I looked at funds to see how they did in both the down market of 2008 and the up market of 2009. Focus on risk.

Let's personalize your content