No Pain, No Gain

Investing Caffeine

MAY 2, 2022

For long-term stock investors who have reaped the massive +520% rewards from the March 2009 lows, they understand this gargantuan climb was not earned without some rocky times along the way.

Investing Caffeine

MAY 2, 2022

For long-term stock investors who have reaped the massive +520% rewards from the March 2009 lows, they understand this gargantuan climb was not earned without some rocky times along the way.

Brown Advisory

DECEMBER 2, 2015

After the 2008-2009 financial crisis, many clients could use loss carry-forwards to reduce taxes against gains taken in subsequent years. A family will then approach its portfolio—and any foul weather in financial markets—with confidence, increasing the likelihood of achieving its long-term goals. .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Carson Wealth

JUNE 12, 2023

Now with stocks up 20%, they have officially entered a new bull market and the 2022 bear is over. Stocks have officially entered a new bull market, increasing the odds of continued strength. Carson’s leading economic index indicates the economy is not in a recession. This has run contrary to most economists’ predictions.

Brown Advisory

NOVEMBER 29, 2016

1 Also, from fiscal year 2009 until fiscal year 2016, federal agencies cut annual grants to private and public organizations by 3.4% Alternatively, nonprofits can boost potential portfolio returns, which often means tolerating more risk and illiquidity, through a recalibration of asset allocation— the single biggest driver of long-term gains.

The Big Picture

JUNE 3, 2024

And so I worked a lot on the asset allocation side. Again, as I said, we’ve worked in asset allocation. So you mentioned financial repression, you and the rest of the quants in your core group, including gun lock, decide to stand up your own firm in 2009. And so it’s not just me.

The Big Picture

JANUARY 31, 2023

Neil Dutta has been doing economic analysis and research from a market-based perspective for over 20 years. I found this to be just an absolutely fascinating discussion about how to best contextualize the world of economic data around you, in a way that’s useful for you as an investor. RITHOLTZ: Of course. RITHOLTZ: Yup.

Darrow Wealth Management

MAY 29, 2024

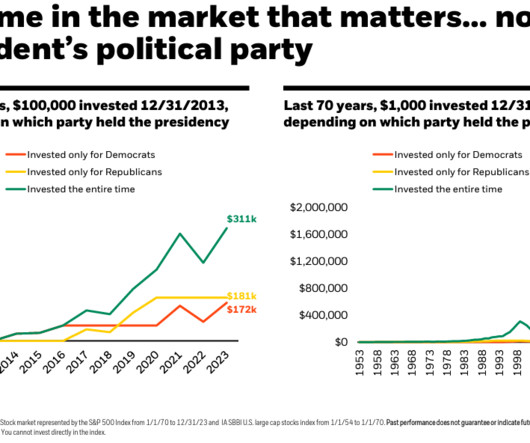

It’s important to keep in mind the myriad of other factors that impact stock market performance aside from who is elected as president of the United States. For example, the September 11th terrorist attacks and the 2008 Great Financial Crisis occurred under President G.W. Since 1926, U.S. Source: BlackRock U.S. Probably not.

Let's personalize your content