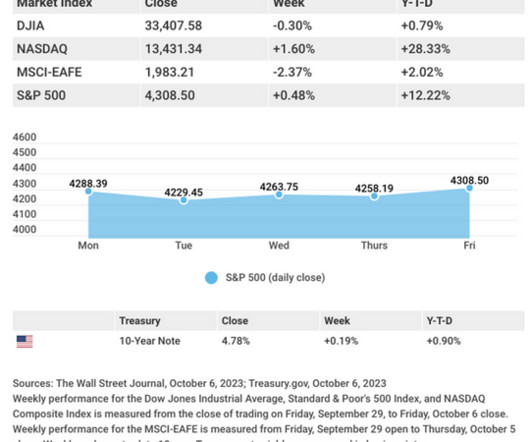

Weekly Market Insights – October 9, 2023

Cornerstone Financial Advisory

OCTOBER 9, 2023

When Treasury yields hit their highest level since 2007 on Tuesday, stock prices dropped, leaving the Dow Industrials in negative territory for the year. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm.

Let's personalize your content