2nd Quarter Market Update

Ballast Advisors

JULY 19, 2023

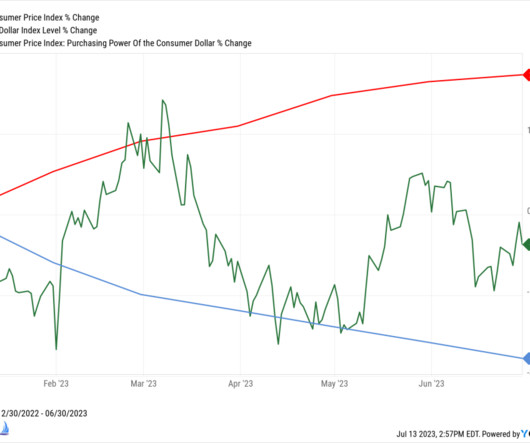

As we reach the end of the second quarter of 2023, we want to provide you with an update on the markets and key developments that have occurred in the economy. economy into a recession? The LEI generally provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term.

Let's personalize your content