My Favorite Charts

The Irrelevant Investor

JANUARY 3, 2018

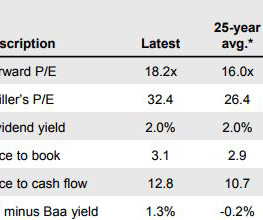

In 2003, it only got down to a low of 20.75, after peaking at 47 in March 2000. investors who allocate to emerging markets. Asset allocation- never the best, never the worst, usually good enough. But this year I went through all of them and picked out my favorite slides, for your viewing pleasure. This is a scary chart.

Let's personalize your content