Four Questions To Discover ‘Actual’ Risk Tolerance Differences In Couples

Nerd's Eye View

MARCH 19, 2025

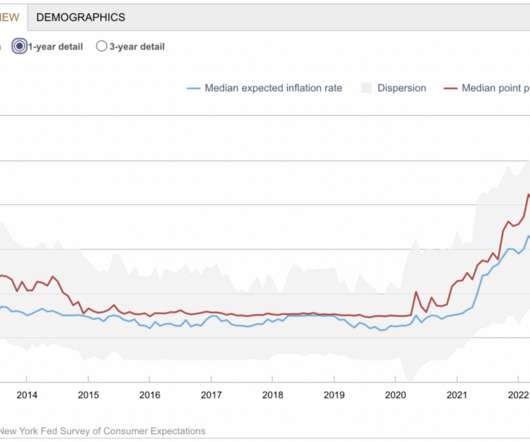

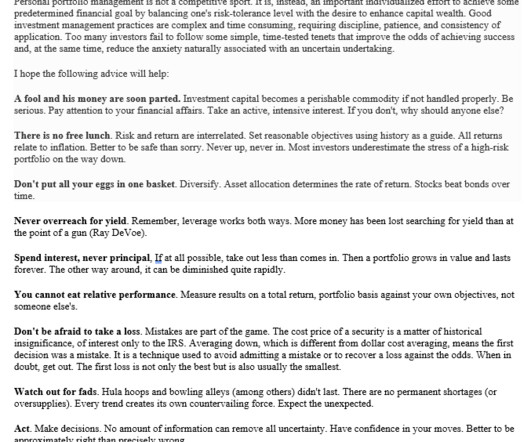

Measuring a client's risk tolerance is both an art and a science. Beyond assessing how a client feels in the moment, advisors must evaluate a client's long-term behavioral tendencies, actual risk capacity, and financial goals – all of which require considerable time and skill.

Let's personalize your content