Impact of New $15M 'Permanent' Estate/Gift Tax Exemption

Wealth Management

JULY 7, 2025

Explore how the new $15 million federal estate tax exemption affects lifetime transfer planning and strategies for high-net-worth clients.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 7, 2025

Explore how the new $15 million federal estate tax exemption affects lifetime transfer planning and strategies for high-net-worth clients.

Wealth Management

JULY 14, 2025

New law increases transfer tax exemptions, raises SALT deduction cap, preserves TCJA rates, expands QSBS benefits and continues QBI deduction.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

FEBRUARY 5, 2025

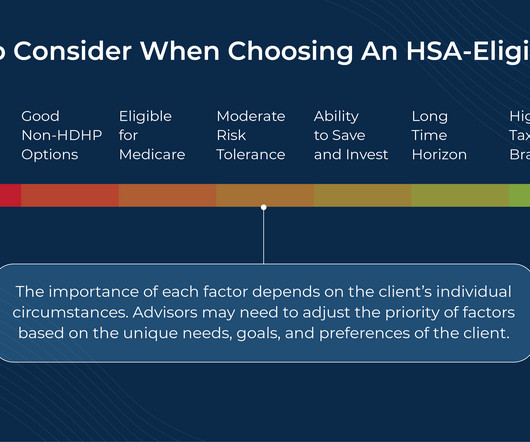

Health Savings Accounts (HSAs) have become an increasingly popular tool for financial advisors and their clients due in part to the 'triple tax savings' they offer: tax-deductible contributions, tax-free growth, and non-taxable distributions for qualifying expenses.

The Big Picture

MARCH 31, 2025

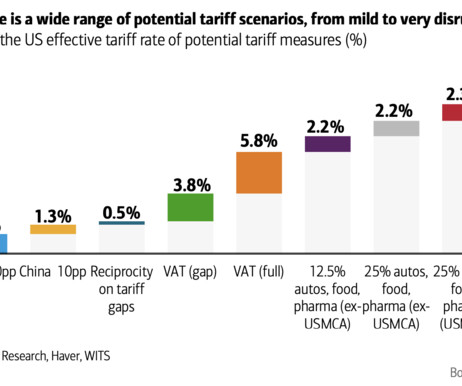

But the way this sell-off feels, and especially how sentiment measures from consumers and CFOs are running on future spending plans and CapEx plans, implies the market is fearing something wicked this way comes. tariff implementation seems to be moving towards the equivalent of a national VAT tax. In a word, the U.S.

Wealth Management

JULY 30, 2025

Anthony Venette , Manager, Valuation Services , Withum July 30, 2025 5 Min Read The passage of recent tax legislation has brought welcome clarity to estate planners and private investors alike. Despite accounting for the majority of most GPs’ compensation, carried interest (carry) is often overlooked in estate planning conversations.

Wealth Management

JULY 9, 2025

Explore how the One Big Beautiful Bill Act impacts estate planning across wealth levels, emphasizing flexibility and income tax strategies for advisors.

Nerd's Eye View

NOVEMBER 25, 2024

Over the past decade, a growing number of advisors have expanded into offering comprehensive financial planning services, reflecting a shift that not only helps them stand out from (increasingly commoditized) portfolio management offerings but also supports clients' broader financial goals.

Nerd's Eye View

JUNE 18, 2025

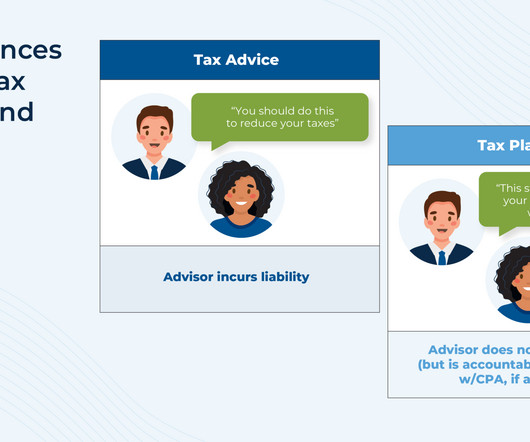

In recent years, financial advisors have increasingly embraced tax planning as a core element of delivering value to clients. Despite this growing interest in tax conversations, most advisors are still quick to distinguish their services as "tax planning", not "tax advice" – a distinction largely driven by liability concerns.

Nerd's Eye View

NOVEMBER 4, 2024

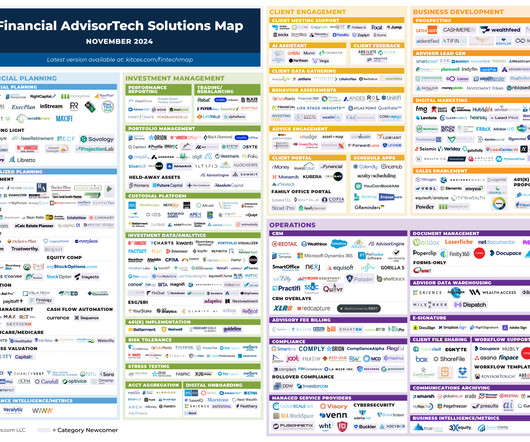

This month's edition kicks off with the news that Holistiplan has announced the rollout of a new estate plan document extraction tool to stand alongside its highly popular tax return scanning tool – which highlights how advances in AI technology have allowed tools like Holistiplan to go beyond tax returns and scan nearly any kind of document (..)

Nerd's Eye View

JANUARY 21, 2025

What's unique about Daniel, though, is how his firm has expanded its tax focus to include "in-house" tax return preparation for its clients as a one-stop shop, but actually outsources the tax preparation work itself to trusted CPAs that he pays out of his own revenue (rather than bringing this service fully in-house) so that he can focus his staff (..)

Nerd's Eye View

NOVEMBER 19, 2024

So, whether you're interested in learning about building a profitable hyperfocused practice, implementing a marketing approach that reaches a firm's ideal target client, or adding value for clients by offering advanced tax planning, then we hope you enjoy this episode of the Financial Advisor Success Podcast, with Anjali Jariwala.

Wealth Management

AUGUST 12, 2025

Intra-Family Loans as a Planning Tool Intra-Family Loans as a Planning Tool A lending strategy worth a second look. When structured properly, this lending strategy offers both flexibility and meaningful estate planning benefits. May be forgiven incrementally over time to leverage annual gift tax exclusions.

Nerd's Eye View

JULY 4, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that Congress has passed highly anticipated tax legislation, making 'permanent' (i.e.,

Nerd's Eye View

FEBRUARY 26, 2025

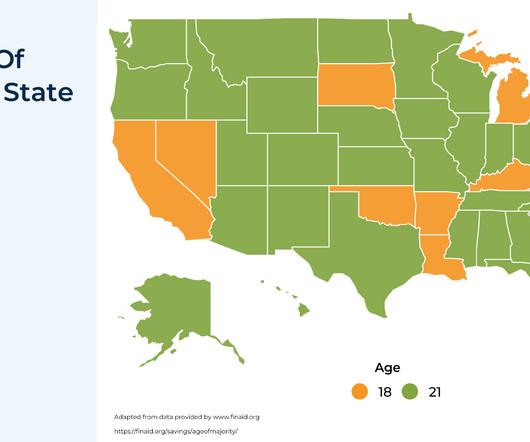

To achieve this, financial support may start at a very young age, allowing for a longer growth horizon and, in many cases, serving tax and estate planning purposes. 529 plans offer greater flexibility in ownership but restrict how funds can be used, particularly for educational expenses. Read More.

Nerd's Eye View

MARCH 12, 2025

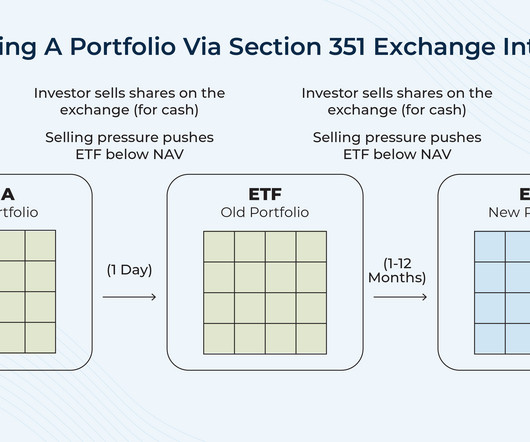

Because when it comes time to rebalance the portfolio to its asset allocation targets – or to reallocate the portfolio to a new strategy – any trades made to implement those changes can generate capital gains, resulting in tax consequences for the investor. Read More.

Wealth Management

JULY 23, 2025

Explore effective estate planning and charitable giving strategies for financial advisors to navigate complex tax policies and help clients maximize wealth.

Carson Wealth

DECEMBER 20, 2024

Strategic charitable giving not only benefits the recipient but can also create significant tax advantages for the giver. While many people approach their financial planning with careful strategy, its easy to overlook the same level of intention when it comes to charitable giving. It just needs to be given to a qualified 501(c)(3).

Nerd's Eye View

JULY 24, 2025

Looking back across the decades, the foundational elements of financial planning have remained surprisingly consistent – from discovery meetings to financial plan presentations – as advisors have striven to help people make sense of their financial lives.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B In 2023, he launched his own firm, Park Hill Financial Planning and Investment Management. “I Resonant Capital Merges with Tax, Accounting Firm QBCo Brennan’s experience is indicative of many young advisors working in the RIA space. Concept of digital social marketing.

The Big Picture

MAY 29, 2025

RWM works with clients by constructing a long-term financial plan, marrying it to an appropriate level of risk in a broadly diversified portfolio built around a core index, and then applying the best technology we can find to generate net after-tax returns with modest risk and volatility. . ~~~ Do you need help with your assets?

The Big Picture

DECEMBER 4, 2024

Would you like to diversify but also defer paying big capital gains taxes? Maybe it’s due to employee stock option plans. Their new ETF is coming out in December 2024: The Cambria TaxAware ETF – symbol TAX – is a solution to address just these challenges of concentrated positions. Maybe there was an IPO or a takeover.

Abnormal Returns

NOVEMBER 6, 2024

podcasts.apple.com) Taxes A year-end tax planning checklist. kindnessfp.com) How to think about taxes in early retirement. marknewfield.substack.com) How to look for holes in your financial plan. contessacapitaladvisors.com) Four steps to an estate plan. whitecoatinvestor.com) Spend your travel rewards.

MainStreet Financial Planning

NOVEMBER 8, 2024

As December unfolds, it’s easy to overlook year-end tax planning amid the holiday hustle. However, dedicating a few moments now can lead to significant savings come tax season. To help you retain more of your hard-earned money and reduce your tax liability, consider these five strategic moves before the year concludes.

Nerd's Eye View

APRIL 8, 2025

Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households. Welcome everyone! Welcome to the 432nd episode of the Financial Advisor Success Podcast!

Nerd's Eye View

NOVEMBER 27, 2024

By integrating philanthropic planning into their services, advisors can add significant value to client relationships and provide more holistic planning. And when clients are enabled to support the causes closest to them, they experience the true impact of a financial plan that aligns with their personal legacy! Read More.

Nerd's Eye View

JULY 18, 2025

Also in industry news this week: A recent survey finds that next-generation employees at broker-dealers are looking for improvements in branding and social media promotion from their firms as they look to build their own practices and take the reins from a rapidly graying advisor population RIA M&A volume hit a record in the first half of 2025 (..)

Wealth Management

JULY 17, 2025

based accounting firm, is taking a page from large registered investment advisors by bringing together taxes and wealth management. In these cases, the RIA will agree to non-solicitation agreements regarding tax clients, but a revenue-sharing model for the wealth management services. Conversely, tax firm Wright Ford Young & Co.

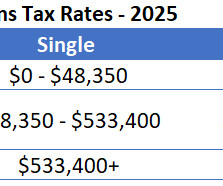

Darrow Wealth Management

NOVEMBER 2, 2024

The IRA and Roth IRA contribution limits are unchanged but income eligibility for tax-deductible IRA contributions and Roth IRA contributions have changed. The 2025 income tax brackets and long-term capital gains tax rates are also updated. The 2025 income tax brackets and long-term capital gains tax rates are also updated.

Nerd's Eye View

JULY 25, 2025

In the report, Schwab also identified key traits of "top performing" firms (including having a defined ideal client persona and a defined client value proposition) and the key strategic initiatives respondents plan to pursue (with generating client referrals topping the list for the third consecutive year, followed by recruiting new staff).

Wealth Management

JUNE 26, 2025

Attorney’s Office said he failed to report the fraud proceeds on his personal income tax returns, which generated a tax loss of about $3 million. Today’s sentencing shows how seriously the courts take federal tax crimes.” "We and Mr. Mason respect and appreciate the court’s judgment yesterday," said Michael J.

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

Wealth Management

JULY 2, 2025

As a result, financial advisors should start honing the services Gen X members will likely benefit from the most, including retirement planning, estate and tax planning and mortgage refinancing. trillion annually over the next decade as part of the great wealth transfer, a new report finds. trillion annually.

Nerd's Eye View

NOVEMBER 28, 2024

Still others may choose a hybrid model, combining AUM fees with additional charges for other services like tax planning. Pricing the impact of financial planning can be challenging, because many of its benefits – like peace of mind – are intangible, compelling in value but difficult to match with an exact price.

Wealth Management

JULY 8, 2025

Sponsored Content Alternative Investments Summit: Navigating the New Frontier Alternative Investments Summit: Navigating the New Frontier Apr 11, 2025 Charles Schwab bank branch Mutual Funds Schwab Expands Roster of No Transaction Fee Mutual Funds Schwab Expands Roster of No Transaction Fee Mutual Funds by David Bodamer Jul 8, 2025 1 Min Read Wealth (..)

Harness Wealth

APRIL 30, 2025

Without proper planning, taxes can unexpectedly take a large bite out of the proceeds, potentially reducing financial security and the legacy. When you understand various exit strategies and their tax implications early, you position yourself to make informed decisions that maximize after-tax value while ensuring a smooth transition.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Wealth Management

AUGUST 8, 2025

As a business owner and organizational leader himself, Jordan intimately understands the time constraints and complexities facing these clients and helps them build a plan to pursue their goals while balancing many different priorities. He began at Deloitte’s individual tax practice, honing his skills in tax and estate planning strategies.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. Find your next tax advisor at Harness today. Starting at $2,500.

Wealth Management

JULY 9, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all fixed income data computer fintech WealthTech Former Citadel Quants Raise $36M for Fixed-Income Fintech Former Citadel Quants Raise $36M for Fixed-Income (..)

Wealth Management

AUGUST 1, 2025

Diana Britton , Executive Editor , WealthManagement.com August 1, 2025 2 Min Read Martine Lellis, principal, M&A partner development, Mercer Advisors Mercer Global Advisors, one of the nation’s largest and most acquisitive registered investment advisors with $77 billion in assets, has purchased Family Wealth Planning Group, a Naples, Fla.-based

Nerd's Eye View

MARCH 7, 2025

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that Congressional Republicans, who recently voted to set a $4.5 equities underperforming international stocks over the next 10 years Why today’s high U.S.

Clever Girl Finance

DECEMBER 23, 2024

Freelancing is liberating, but without a solid financial plan, it can also be unpredictable. As a freelancer, you juggle not only your craft but also your finances, taxes, and retirement planning. That’s where financial planning for freelancers comes in. Plan for taxes ahead of time 4.

Nerd's Eye View

AUGUST 11, 2025

In this article, Mark Tenenbaum, Kitces.com's Director of Advisor Research, explores findings from the latest Kitces Research study on advisor productivity, "How Financial Planners Actually Do Financial Planning". Proactive planning and structured onboarding – especially for Associate Advisors – are essential for success.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content