Financial market round-up – Jul’25

Truemind Capital

JULY 18, 2025

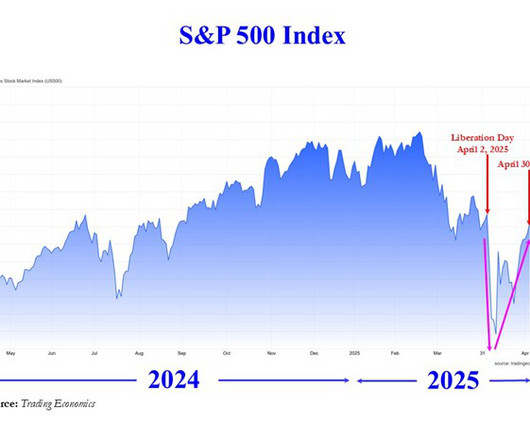

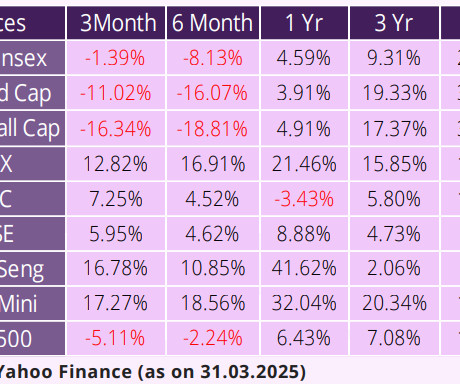

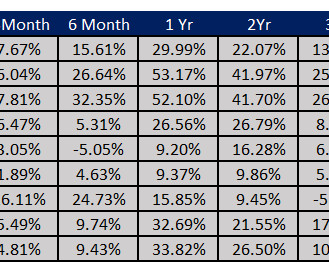

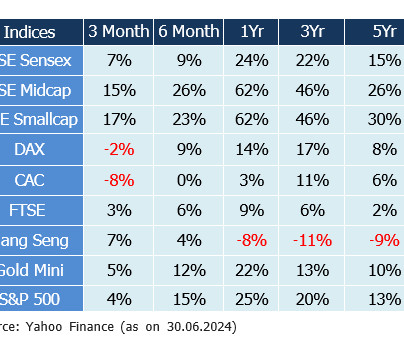

We saw some important factors coming together to weigh on the market sentiment during this time. Ahead of elections, the government reduced spending, and the RBI tightened liquidity by Rs 3–4 lakh crore to support the rupee. The post Financial market round-up – Jul’25 appeared first on Investment Blog.

Let's personalize your content