Utilizing Swap Powers In Irrevocable Trusts To Add Flexibility And Income Tax Efficiency

Nerd's Eye View

AUGUST 21, 2024

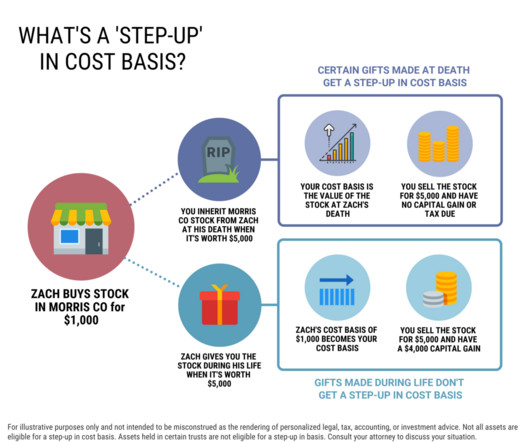

Irrevocable trusts lie at the heart of a variety of estate planning strategies, as gifts to irrevocable trusts can allow for the transfer of assets outside of an owner’s estate for estate tax purposes with more structure than an outright gift. the assets' original owner).

Let's personalize your content