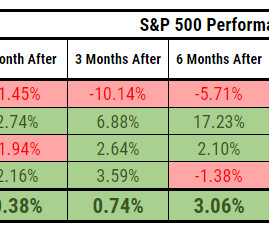

Animal Spirits: Best Case Recession

The Irrelevant Investor

AUGUST 28, 2019

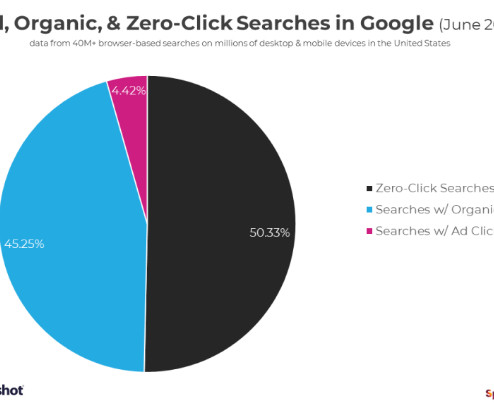

On today's show we discuss Don't say no to YES Streaming and bundles Google search results Why is Joe Rogan so popular Student loan survey (believe this one) Noobwhale.com (funding secured) Listen here: Recommendations Bitcoin Billionaires Koppelman with Mezrich Land of the Giants (podcast) Tweets [link] [link] [link] The post Animal Spirits: Best Case Recession appeared first on The Irrelevant Investor.

Let's personalize your content