Firearms Versus Bow and Arrows

The Irrelevant Investor

JANUARY 31, 2017

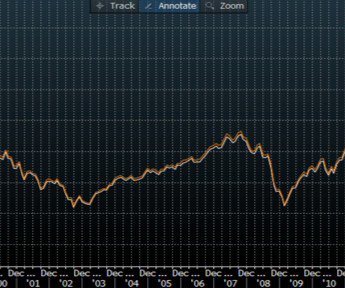

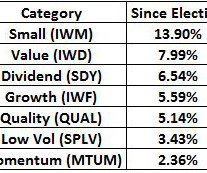

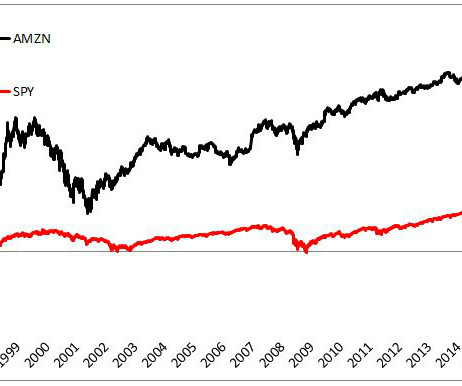

"Every stock market system with an edge is necessarily limited in the amount of money it can use and still produce extra returns." - Ed Thorp In the decade after Ed thorp launched Princeton Newport Partners, the fund gained 409%, annualizing at 17.7% before fees and 14.1% after. Not bad for a market neutral portfolio. Over the same period, the S&P 500 annualized at just 4.6%, including dividends.

Let's personalize your content