Cetera Affiliate Adds $327M Atlanta Team from MML

Wealth Management

OCTOBER 11, 2023

Advisors Raymond Bardoul and Brian Fox will establish an Atlanta office for Totus Wealth Management, an OSJ of Cetera Advisors.

Wealth Management

OCTOBER 11, 2023

Advisors Raymond Bardoul and Brian Fox will establish an Atlanta office for Totus Wealth Management, an OSJ of Cetera Advisors.

Calculated Risk

OCTOBER 11, 2023

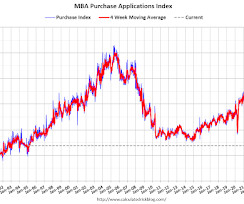

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 0.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 6, 2023. The Market Composite Index, a measure of mortgage loan application volume, increased 0.6 percent on a seasonally adjusted basis from one week earlier.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 11, 2023

But the existential threat to the regulator remains unresolved.

Nerd's Eye View

OCTOBER 11, 2023

In 2004, the SEC significantly strengthened the compliance responsibilities of investment advisers when Rule 206(4)-7 (also known as the "Compliance Rule") went into effect, requiring them to adopt and implement written compliance policies and procedures, review such policies and procedures annually, and designate a Chief Compliance Office to administer such policies and procedures.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

OCTOBER 11, 2023

Nearly 70 new ETFs made their market debuts in September. That included 21 bond ETFs, one commodities ETF, 41 equities-based ETFs and six target date/multi-asset ETFs.

Calculated Risk

OCTOBER 11, 2023

From the Fed: Minutes of the Federal Open Market Committee, September 19-20, 2023. Excerpt: Participants noted that the data received over the past several months generally suggested that inflation was slowing. Even with these favorable developments, they emphasized that further progress was needed to get inflation sustainably to 2 percent. Participants pointed to the softening of price inflation for goods amid improving supply conditions and to declining housing services inflation.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Big Picture

OCTOBER 11, 2023

Exciting news! I am heading to Charlotte next month, and I will be bringing a full complement of the crew with me! We will be meeting with clients and hanging with the team from our Charlotte offices. We are also meeting prospective clients and interviewing a few new folks for the firm. You can join me, Josh Brown, Michael Batnick and Blair duQuesnay and several of our financial advisors, including Managing Partner Kris Venne, and Ritholtz Wealth’s President, Jay Tini.

Wealth Management

OCTOBER 11, 2023

Lumature Wealth Partners, with $700 million in client assets, has left Raymond James to go independent with the newly restructured Concurrent.

Calculated Risk

OCTOBER 11, 2023

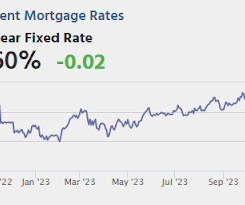

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, up from 204 thousand last week. • Also at 8:30 AM, The Consumer Price Index for September from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI.

Wealth Management

OCTOBER 11, 2023

Fred Barstein, contributing editor for RPA Edge, reviews all of the week’s industry news and selects the five important/interesting stories.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

OCTOBER 11, 2023

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in September A brief excerpt: This is the second look at several early reporting local markets in September. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Wealth Management

OCTOBER 11, 2023

The co-founder and former chief investment officer of Pacific Investment Management Co. has been growing increasingly vocal in recommending the strategy, which involves betting on the outcome of corporate takeovers.

Advisor Perspectives

OCTOBER 11, 2023

The financial planning landscape is undergoing a great transformation, driven by emerging trends that have accelerated in recent years.

Wealth Management

OCTOBER 11, 2023

This tax relief package is intended to make Massachusetts a more attractive and affordable place to live and operate a business.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

A Wealth of Common Sense

OCTOBER 11, 2023

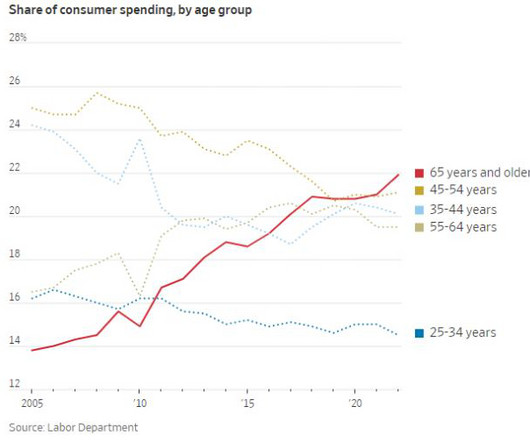

Today’s Animal Spirits is brought to you by YCharts: See here to register for YCharts webinar discussing this quarter’s top 10 visuals for clients and prospects. See here for more information on our live event, live from the Nascar Hall of Fame! On today’s show, we discuss: Are bond yields too high, or too low? The US economy’s secret weapon: Seniors with money to spend Investors are yanking c.

Wealth Management

OCTOBER 11, 2023

It’s not just the technical, it’s also the technique.

Advisor Perspectives

OCTOBER 11, 2023

The odds of a unicorn spraying rainbows across the sky and the government running a surplus are the same: zero percent.

Wealth Management

OCTOBER 11, 2023

Wealth managers look for opportunities in an evolving risk environment.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

OCTOBER 11, 2023

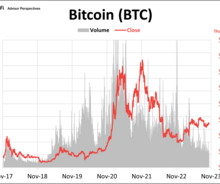

Bitcoin's price hovered above $27,000 during this past week and is now up ~67% year to date. Here's the latest charts on three of the largest cryptocurrencies by market share through 10/10.

Wealth Management

OCTOBER 11, 2023

Unlock the secrets to success in the ever-evolving world of wealth management with the 2023 RIA Edge Study.

AdvicePay

OCTOBER 11, 2023

When you're scouting for cutting-edge tech solutions for your firm, what's at the top of your checklist? Whether you are aiming to boost productivity, keep a competitive edge, or seamlessly expand your operations, it all boils down to one crucial metric – getting the best bang for your buck! Or, as we put it in more formal terms, achieving an impressive return on investment (ROI).

Wealth Management

OCTOBER 11, 2023

There is no playbook on how to find a successor with the right chemistry, availability and skills.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Random Roger's Retirement Planning

OCTOBER 11, 2023

For this post I wanted to follow up on some portfolios we constructed last summer as well as tie in a new idea to those year old portfolios. As I was looking through last summer's content I saw that I really wrote a lot of articles crapping on risk parity funds like RPAR, UPAR and WFRPX but we'll circle back to those in just a bit. A major focus of all these related posts about return stacking, using alternatives and yes, crapping on risk parity has been that there are plenty of ways to construc

Wealth Management

OCTOBER 11, 2023

The third quarter was also characterized by large direct investments, showing private equity interest is still strong.

Advisor Perspectives

OCTOBER 11, 2023

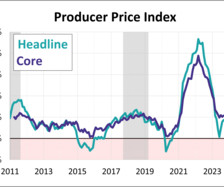

Wholesale inflation rose more than expected in September as producer price growth increased for a third straight month. The producer price index for final demand was up 0.5% month-over-month (s.a.). On an annual basis, headline PPI accelerated from 2.0% in August to 2.2% in September, its highest level since April.

Wealth Management

OCTOBER 11, 2023

The agency’s moral authority may be eroded by how aggressively it has fined institutions for behavior everyone else thought was legal. Pushback may follow.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Meb Faber Research

OCTOBER 11, 2023

Episode #503: Jon Hirtle, Hirtle, Callaghan & Co. – OCIO Pioneer Guest: Jon Hirtle is the founder and Executive Chairman of Hirtle, Callaghan & Co., a 20 billion dollar Outsourced CIO business he founded over 35 years ago. Jon is well known for creating the OCIO model that is commonplace today. Date Recorded: 9/27/2023 | Run-Time: […] The post Episode #503: Jon Hirtle, Hirtle, Callaghan & Co. – OCIO Pioneer appeared first on Meb Faber Research - Stock Market and Investi

Wealth Management

OCTOBER 11, 2023

There is no playbook on how to find a successor with the right chemistry, availability and skills.

Advisor Perspectives

OCTOBER 11, 2023

Any successful implementation of a new technology depends on effective communication.

Wealth Management

OCTOBER 11, 2023

Listen as Martin Tarlie, Director, Product Lead, GMO, discusses how their 2023 Wealthies Initiatives help financial advisors.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content