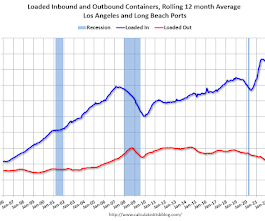

LA Port Inbound Traffic Down 22% YoY in January

Calculated Risk

FEBRUARY 19, 2023

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago ), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast. Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

Let's personalize your content