BLS: Job Openings Decreased to 7.6 million in December

Calculated Risk

FEBRUARY 4, 2025

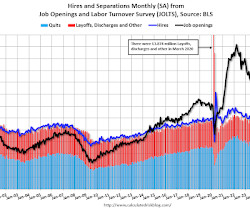

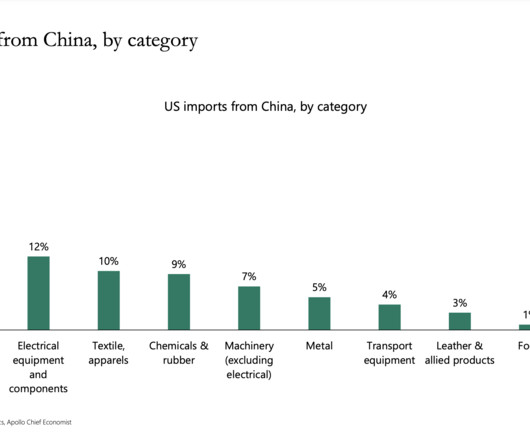

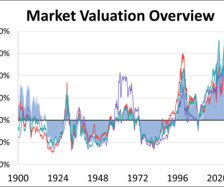

From the BLS: Job Openings and Labor Turnover Summary The number of job openings decreased to 7.6 million on the last business day of December, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and total separations were little changed at 5.5 million and 5.3 million, respectively. Within separations, quits (3.2 million) and layoffs and discharges (1.8 million) changed little. emphasis added The following graph shows job openings (black line), hires (dark blue), Layoff, Di

Let's personalize your content