Recession

The Irrelevant Investor

MAY 24, 2022

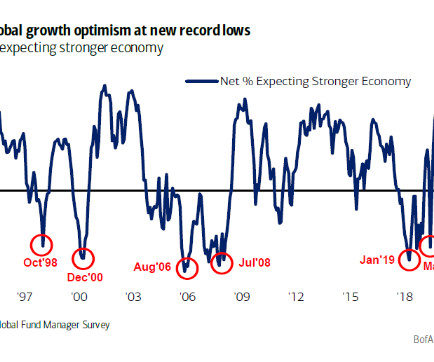

The bad news is piling up. The recession that people are looking for may already be here. We heard about inventory buildup at Target and Walmart last week and the stocks responded with their worst day since.1987. Those were not isolated incidents. This week we heard the same from Kohl's and Abercrombie, whose stock is cratering 30% on the news. In other news, Snap just warned of an imminent slowdown.

Let's personalize your content