Financial market round-up – Apr’25

Truemind Capital

APRIL 18, 2025

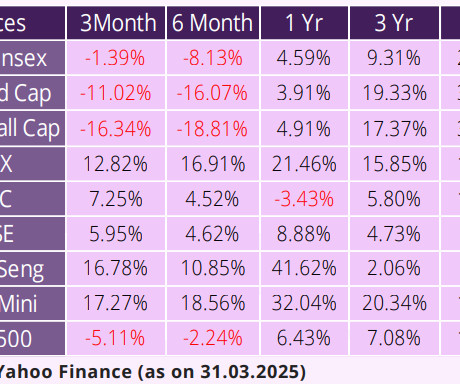

Equity Market Insights: And It All Falls Down… Over the past few quarters, weve consistently shared our view that a valuation reset was overdue in India, particularly in the mid and small-cap segments. This quarter, that reset finally arrived with the sugar rush coming to an end. During the quarter, Indian equity benchmarks posted their fifth consecutive monthly decline, marking the longest losing streak in nearly three decades.

Let's personalize your content