Newsletter: Housing Starts Decreased to 1.366 million Annual Rate in January

Calculated Risk

FEBRUARY 19, 2025

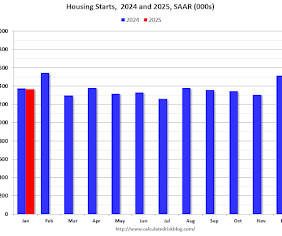

Today, in the Calculated Risk Real Estate Newsletter: Housing Starts Decreased to 1.366 million Annual Rate in January A brief excerpt: Total housing starts in January were below expectations; however, starts in November and December were revised up. The third graph shows the month-to-month comparison for total starts between 2024 (blue) and 2025 (red).

Let's personalize your content