Real Estate Newsletter Articles this Week: Existing-Home Sales Decreased to 4.09 million SAAR in November

Calculated Risk

DECEMBER 24, 2022

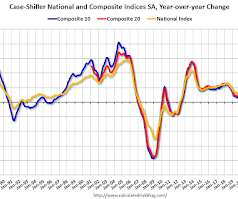

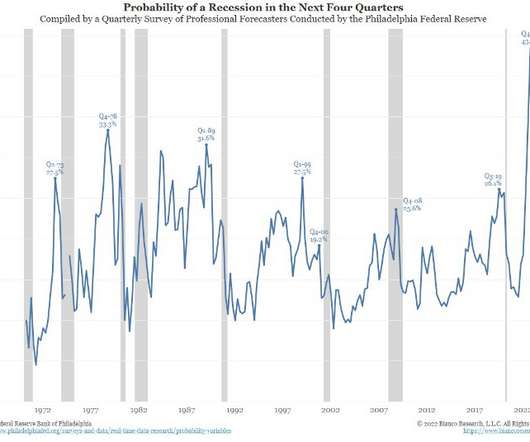

At the Calculated Risk Real Estate Newsletter this week: • NAR: Existing-Home Sales Decreased to 4.09 million SAAR in November • November Housing Starts: Record Number of Housing Units Under Construction • New Home Sales Increased in November; Previous 3 Months Revised Down Sharply • Lawler: Update on Rent Trends • 4th Look at Local Housing Markets in November; California Sales off 48% YoY This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Let's personalize your content